## Page 003

United States Rubber Company

PROXY STATEMENT

Solicitation of Proxies

Execution and return of the enclosed proxy, which may be revoked by written request to the secretary at any time before it is voted, is being solicited on behalf of the management of the company for use at the annual meeting of stockholders to be held April 21, 1964, for the purposes set forth in the accompanying notice of meeting. The cost of solicitation of proxies, including the cost of reimbursing banks and brokers for forwarding proxies and proxy statements to their principals, will be borne by the company. Proxies will be solicited without extra compensation by certain officers and regular employees of the company by mail, telephone, telegraph or personally. All shares represented by valid proxies will be voted; and, where a stockholder has specified a choice by marking any of the ballots in the form of proxy, his shares will be voted as so specified. As stated in the form of proxy, if a stockholder does not otherwise specify, his shares will be voted in favor of continuing the company’s Bonus Plan in effect (as referred to in item “2” in the accompanying notice of meeting and as described below), in favor of continuing the company’s Management Incentive Plan in effect (as referred to in item “3” in said notice and as described below), and in favor of adopting the proposed 1964 Stock Option Plan (as referred to in item “4” in said notice and as described below).

Voting Securities and Record Date

On January 31, 1964, the total number of shares of first preferred stock outstanding was 642,091, and the total number of shares of common stock outstanding was 5,549,014. Each stockholder is entitled to one vote for each share of preferred and one vote for each share of common stock registered in his name on the company’s books on March 4, 1964, at the close of business, the record date for the determination of stockholders entitled to vote at the annual meeting.

Matters to be Considered

The management does not know of any matters to be considered at the annual meeting other than those referred to in items “1”, “2”, “3” and “4” in the accompanying notice. If any other business should come before the meeting, the proxy will be voted in respect therein, and discretionary authority to do so is included in the proxy.

Nominees for Election as Directors

The persons named as proxies intend to cast all votes pursuant to the enclosed form of proxy for fixing the number of directors at 15 and for the election as directors of the 15 persons listed on the following page, hereinafter called “nominees,” upon their nomination for such office at the annual meeting. Directors so elected will hold office for one year and until others are chosen and qualified in their stead. In the event of the decease or incapacity of any of the nominees prior to the election, or the refusal or inability of any of the nominees to accept nomination or election (none of which eventualities is now expected), the persons named as proxies intend to cast all such votes for the election, as director or directors, upon nomination at the annual meeting, of such other person or persons as may be recommended or designated for such nomination and election by a majority of the then members of the board of directors of the company. Certain information as to the nominees is set forth in Table I below and on pages 5-7.

—

## Page 004

TABLE I — INFORMATION CONCERNING NOMINEES FOR DIRECTOR

Approximate amount of

each class of stock of the

company beneficially owned

directly or indirectly

January 24, 1964

Nominee for director Principal occupation or employment Year first Common First

became Preferred

director

Eugene N. Beesley President, Eli Lilly and Company, 1959 100 —

Indianapolis, Ind.

J. Simpson Dean President, Nemours Corporation. 1960 1,600 —

Wilmington, Del.

George P. Edmonds Chairman of the board of directors, Wilmington 1944 2,000 —

Trust Company. Member of the executive com-

mittee of the company.

Wilmington, Del.

Malcolm P. Ferguson President, Bendix Corporation. 1957 200 —

Detroit, Mich.

G. Arnold Hart President, Bank of Montreal. 1961 100 —

Montreal, Canada

Harold H. Helm Chairman of the board of directors, Chemical 1957 802 —

Bank New York Trust Company.

New York, N. Y.

H. E. Humphreys, Jr. Chairman of the board of directors and chairman 1938 10,000 —

of the executive committee of the company.

New York, N. Y.

James P. Lewis* President, The J. P. Lewis Company, 1962 200 —

Beaver Falls, N. Y.

John W. McGovern Member of the executive committee of the com- 1951 8,097 —

pany. Former president.

New York, N. Y.

Robert J. McKim Chairman of the board of directors, Associated Dry 1961 200 —

Goods Corporation.

New York, N. Y.

John M. Schiff Partner of Kuhn, Loeb & Co., investment bankers. 1958 10,000 —

Member of the executive committee of the company.

New York, N. Y.

W. Dent Smith President, Terminal Warehouses, Ltd. 1956 508 —

Toronto, Canada

Charles M. Spofford Partner of Davis Polk Wardwell Sunderland & 1962 200 —

Kiendl, attorneys.

New York, N. Y.

George R. Vila President and vice chairman of the executive 1960 2,894 —

committee of the company.

New York, N. Y.

Medley G. B. Whelpley Member of the executive committee of the com- 1940 1,000 —

pany. Retired corporate executive.

New York, N. Y.

* By reason of his direct and indirect beneficial ownership of stock of The Beaver River Power Corporation and that corporation’s beneficial ownership of 50% of the preferred stock and 49% of the common stock of Latex Fiber Industries, Inc., Mr. Lewis beneficially owned indirectly, as of January 24, 1964, 17% of the preferred stock and 16.66% of the common stock of Latex Fiber Industries, Inc., one of the company’s subsidiaries.

—

## Page 005

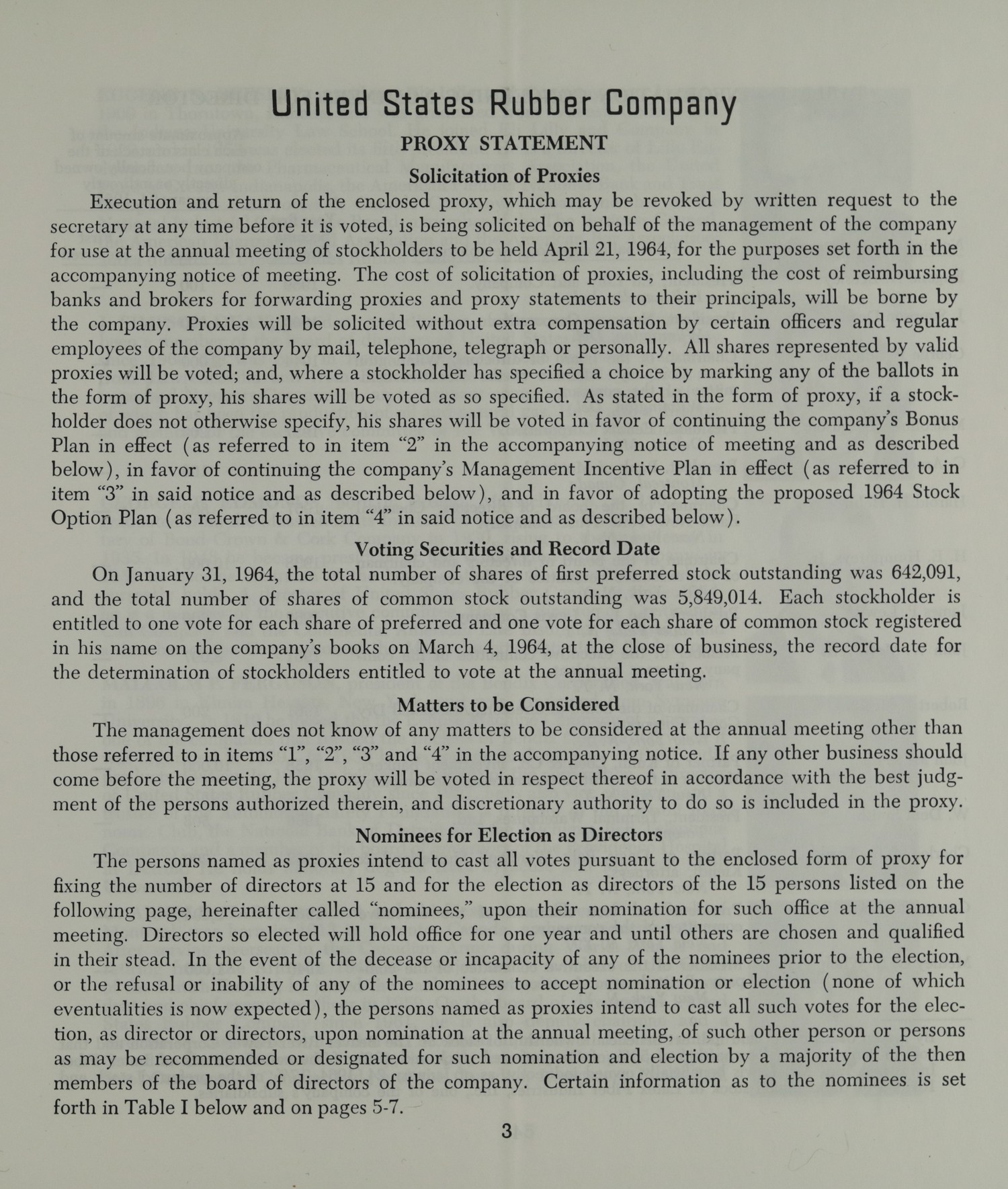

EUGENE N. BEESLEY, president, Eli Lilly and Company, was born in 1909 in Thorntown, Indiana, and was graduated from Wabash College and the Indiana University Law School. He joined Eli Lilly and Company in 1929, and in 1953 was elected its fifth president. He is a director of Lilly Endowment, Inc., the Pharmaceutical Manufacturers Association, the United Fund of Greater Indianapolis, the American Fletcher National Bank and Trust Company, and the Procter & Gamble Company; a board member of the National Industrial Conference Board; a member of the Business Council, the American Pharmaceutical Association; and a director of United States Rubber Company since 1959.

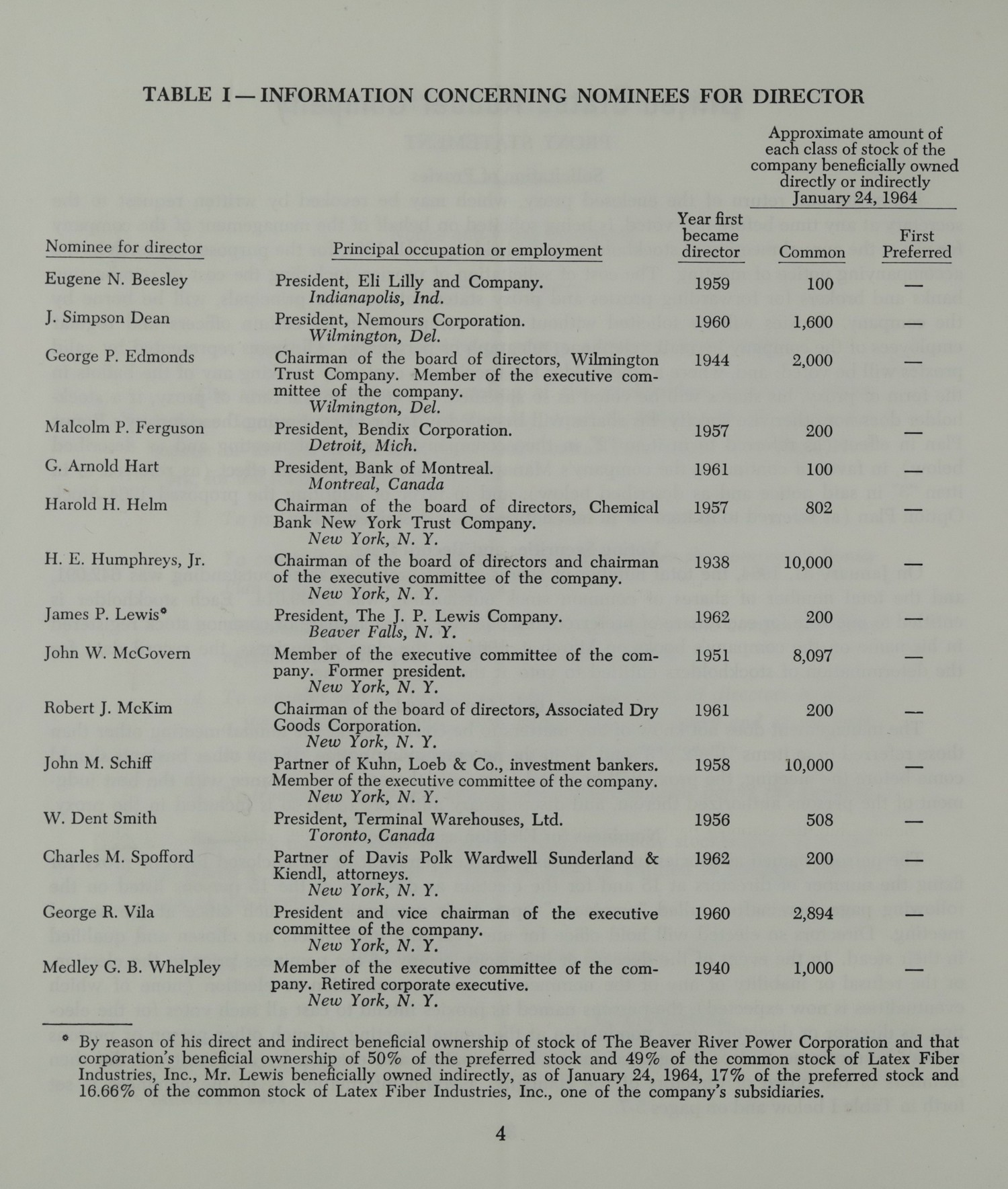

J. SIMPSON DEAN, president and director of Nemours Corporation, has been a member of the board of directors of United States Rubber Company since 1960. He was born in Rome, Georgia, in 1898 and was graduated from Lawrenceville and from Princeton University in 1921. In 1924 he organized Nemours Corporation, an investment company, the major activity of which has been the production of oil and natural gas. He is also a director and member of the executive committee of the Wilmington Trust Company.

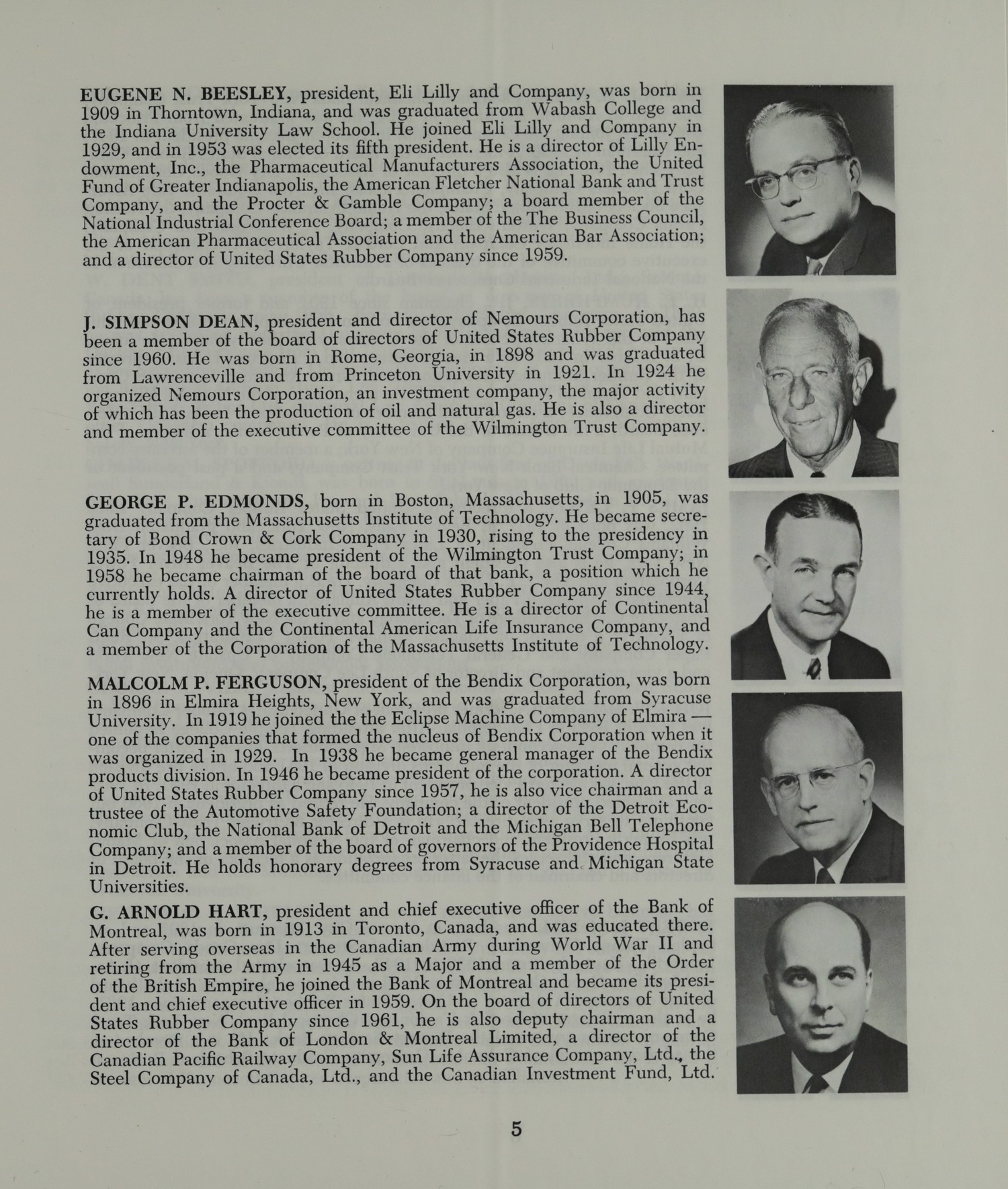

GEORGE P. EDMONDS, born in Boston, Massachusetts, in 1905, was graduated from the Massachusetts Institute of Technology. He became secretary of Bond Crow & Cork Company in 1930, rising to the presidency in 1935. In 1948 he became president of the Wilmington Trust Company; in 1953 he became chairman of the board of that bank, a position which he currently holds. A director of United States Rubber Company since 1944, he is a member of the executive committee. He is a director of Continental Can Company and the Continental American Life Insurance Company, and a member of the Corporation of the Massachusetts Institute of Technology.

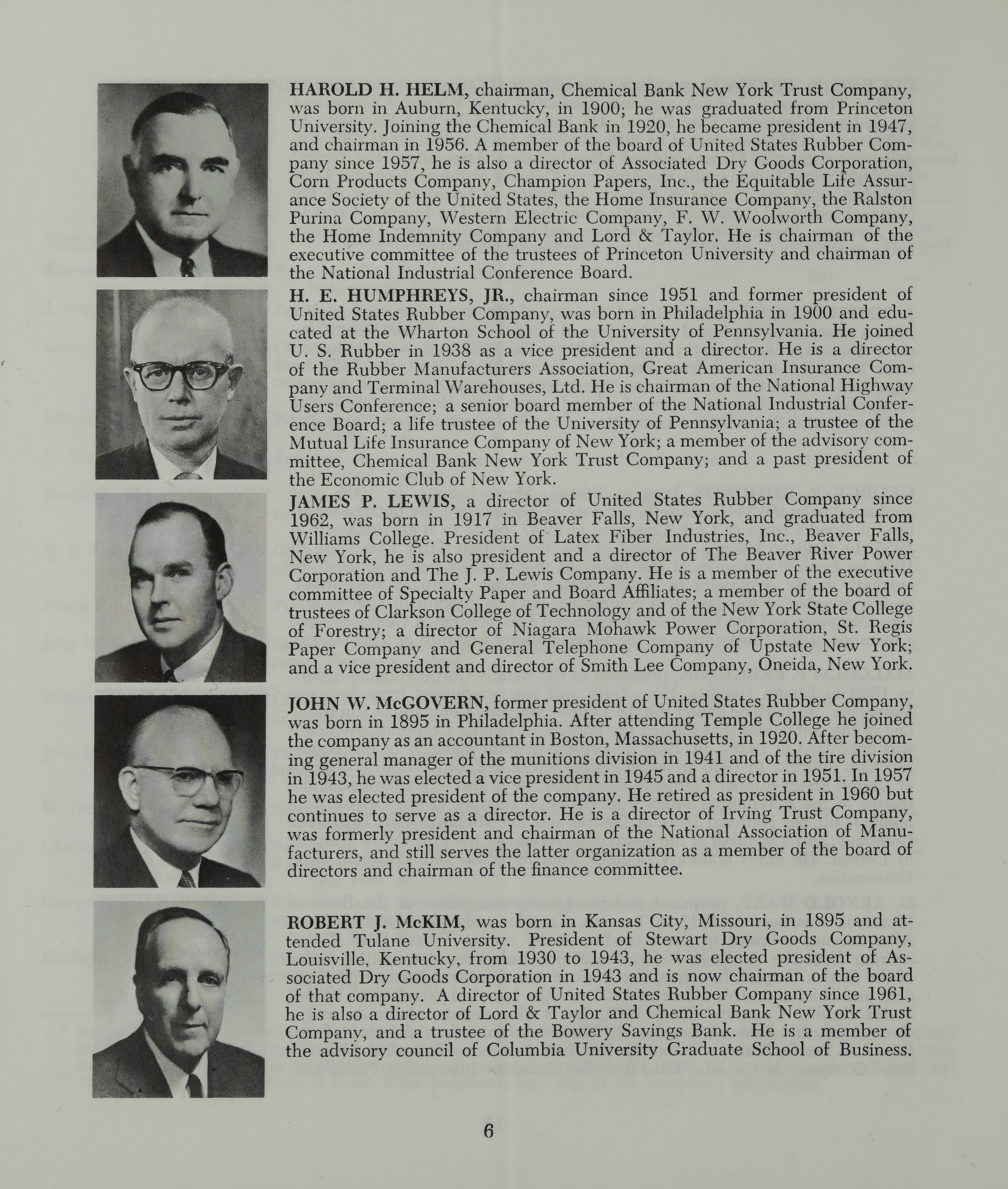

MALCOLM P. FERGUSON, president of the Bendix Corporation, was born in 1896 in Elmira Heights, New York, and was graduated from Syracuse University. In 1919 he joined the Eclipse Machine Company of Elmira — one of the companies that formed the nucleus of Bendix Corporation when it was organized in 1929. In 1938 he became general manager of the Bendix products division. In 1946 he became president of the corporation. A director of United States Rubber Company since 1957, he is also vice chairman and a trustee of the Automotive Safety Foundation; a director of the National Bank of Detroit and the Michigan Bell Telephone Company; and a member of the board of governors of the Providence Hospital in Detroit. He holds honorary degrees from Syracuse and Michigan State Universities.

G. ARNOLD HART, president and chief executive officer of the Bank of Montreal, was born in 1913 in Toronto, Canada, and was educated there. After serving overseas in the Canadian Army during World War II and retiring from the Army in 1945 as a Major and a member of the Order of the British Empire, he joined the Bank of Montreal and became its president and chief executive officer in 1959. On the board of directors of United States Rubber Company since 1961, he is also deputy chairman and a director of the Bank of London & Montreal Limited, a director of the Canadian Pacific Railway Company, Sun Life Assurance Company, Ltd., the Steel Company of Canada, Ltd., and the Canadian Investment Fund, Ltd.

—

## Page 006

HAROLD H. HELM, chairman, Chemical Bank New York Trust Company, was born in Auburn, Kentucky, in 1900; he was graduated from Princeton University. Joining the Chemical Bank in 1920, he became president in 1947, and chairman in 1956. A member of the board of United States Rubber Company since 1957, he is also a director of Associated Dry Goods Corporation, Champion Papers, Inc., the Equitable Life Assurance Society of the United States, the Home Insurance Company, the Ralston Purina Company, Western Electric Company, F. W. Woolworth Company, the Home Indemnity Company and Lord & Taylor. He is chairman of the executive committee of the trustees of Princeton University and chairman of the National Industrial Conference Board.

H. E. HUMPHREYS, JR., chairman since 1951 and former president of United States Rubber Company, was born in Philadelphia in 1900 and educated at the Wharton School of the University of Pennsylvania. He joined U. S. Rubber in 1935 as a vice president and a director. He is a director of the Rubber Manufacturers Association, Great American Insurance Company and Terminal Warehouses, Ltd. He is chairman of the National Highway Users Conference; a senior board member of the National Industrial Conference Board; a life trustee of the University of Pennsylvania; a trustee of the Mutual Life Insurance Company of New York; a member of the advisory committee, Chemical Bank New York Trust Company; and a past president of the Economic Club of New York.

JAMES P. LEWIS, a director of United States Rubber Company since 1962, was born in 1917 in Beaver Falls, New York, and graduated from Williams College. President of Latex Fiber Industries, Inc., Beaver Falls, New York, he is also president and a director of The Beaver River Power Corporation and The J. P. Lewis Company. He is a member of the executive committee of Specialty Paper and Board Affiliates; a member of the board of trustees of Clarkson College of Technology and of Forestry; a director of Niagara Mohawk Power Corporation, St. Regis Paper Company and General Telephone Company of Upstate New York; and a vice president and director of Smith Lee Company, Oneida, New York.

JOHN W. McGOVERN, former president of United States Rubber Company, was born in 1895 in Philadelphia. After attending Temple College he joined the company as an accountant in Boston, Massachusetts, in 1920. After becoming general manager of the munitions division in 1941 and of the tire division in 1943, he was elected a vice president in 1945 and a director in 1951. In 1957 he was elected president of the company. He retired as president in 1960 but continues to serve as a director. He is a director of Irving Trust Company, was formerly president and chairman of the National Association of Manufacturers, and still serves the latter organization as a member of the board of directors and chairman of the finance committee.

ROBERT J. McKIM, was born in Kansas City, Missouri, in 1895 and attended Tulane University. President of Stewart Dry Goods Company, Louisville, Kentucky, from 1930 to 1943, he was elected president of Associated Dry Goods Corporation in 1943 and is now chairman of the board of that company. A director of United States Rubber Company since 1961, he is also a director of Lord & Taylor and Chemical Bank New York Trust Company, and a trustee of the Savings Bank. He is a member of the advisory council of the Columbia University Graduate School of Business.

—

## Page 007

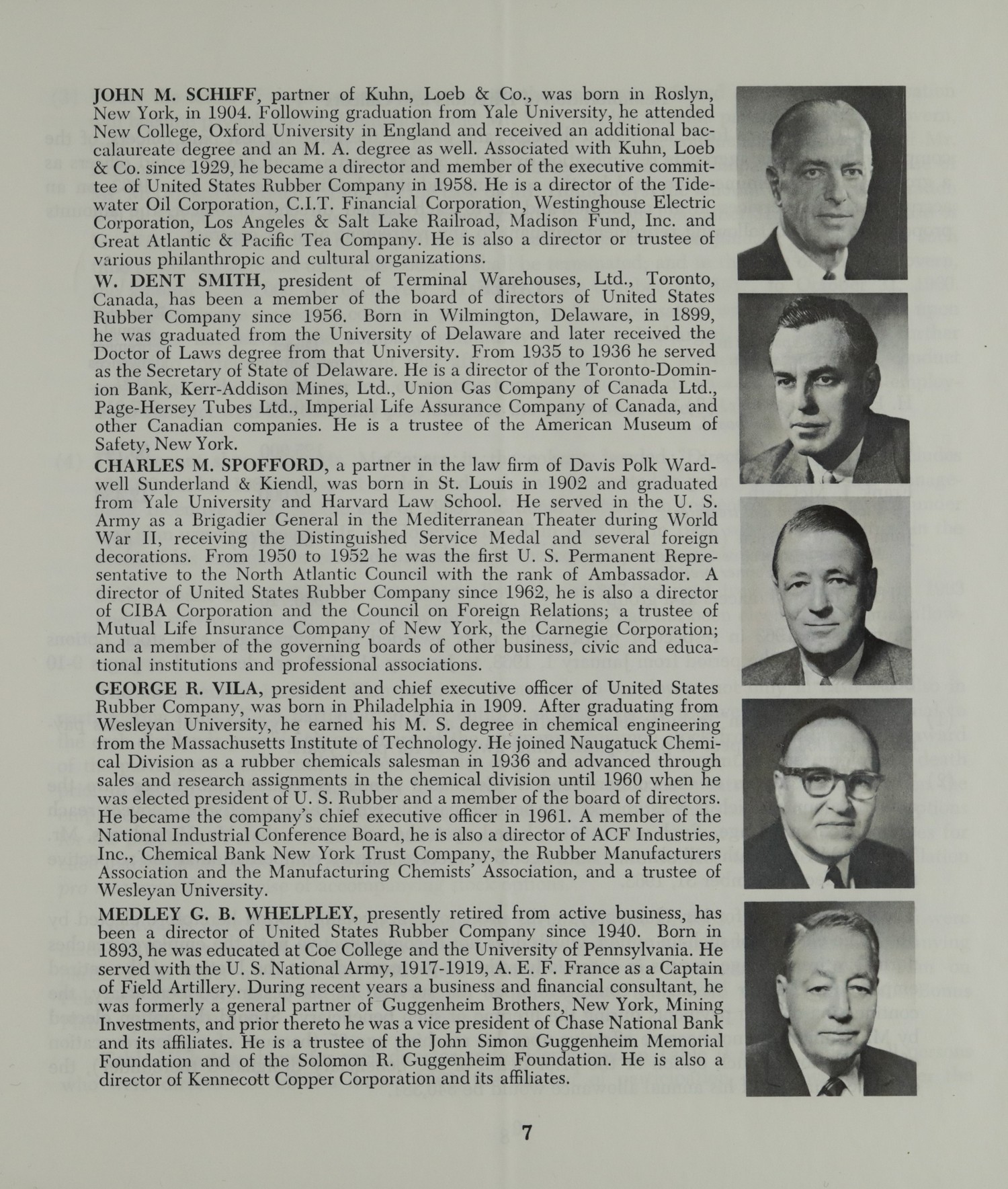

JOHN M. SCHIFF, partner of Kuhn, Loeb & Co., was born in Roslyn, New York, in 1904. Following graduation from Yale University, he attended New College, Oxford University in England and received an additional bac-

calaurcatc degree and an M.A. degree as well. Associated with Kuhn, Loeb

& Co. since 1929, he became a director and member of the executive commit-

tee of United States Rubber Company in 1958. He is a director of the Tide-

water Oil Corporation, C.I.T. Financial Corporation, Westinghouse Electric

Corporation, Los Angeles & Salt Lake Railroad, Madison Fund, Inc. and

Great Atlantic & Pacific Tea Company. He is also a director or trustee of

various philanthropic and cultural organizations.

W. DENT SMITH, president of Terminal Warehouses, Ltd., Toronto,

Canada, has been a member of the board of directors of United States

Rubber Company since 1956. Born in Wilmington, Delaware, in 1899,

he was graduated from the University of Delaware and later received the

Doctor of Laws degree from that University. From 1935 to 1936 he served

as the Secretary of State of Delaware. He is a director of the Toronto-Domin-

ion Bank, Kerr-Addison Mines, Ltd., Union Gas Company of Canada Ltd.,

Page-Hersey Tubes Ltd., Imperial Life Assurance Company of Canada, and

other Canadian companies. He is a trustee of the American Museum of

Safety, New York.

CHARLES M. SPOFFORD, a partner in the law firm of Davis Polk Ward-

well Sunderland & Kiendl, was born in St. Louis in 1902 and graduated

from Yale University and Harvard Law School. He served in the U. S.

Army as a Brigadier General in the Mediterranean Theater during World

War II, receiving the Distinguished Service Medal and several foreign

decorations. From 1950 to 1952 he was the first U. S Permanent Repre-

sentative to the North Atlantic Council with the rank of Ambassador. A

director of United States Rubber Company since 1962, he is also a director

of CIBÄ Corporation and the Council on Foreign Relations; a trustee of

Mutual Life Insurance Company of New York, the Carnegie Corporation;

and a member of the governing boards of other business, civic and educa-

tional institutions and professional associations.

GEORGE R. VILA, president and chief executive officer of United States

Rubber Company, was born in Philadelphia in 1909. After graduating from

Wesleyan University, he earned his M. S. degree in chemical engineering

from the Massachusetts Institute of Technology. He joined Naugatuck Chemi-

cal Division as a rubber chemicals salesman in 1936 and advanced through

sales and research assignments in the chemical division until 1960 when he

was elected president of U. S. Rubber and a member of the board of directors.

He became the company’s chief executive officer in 1961. A member of the

National Industrial Conference Board, he is also a director of ACF Industries,

Inc., Chemical Bank New York Trust Company, the Rubber Manufacturers

Association and the Manufacturing Chemists Association, and a trustee of

Wesleyan University.

MEDLEY G. B. WHELPLEY, presently retired from active business, has

been a director of United States Rubber Company since 1940. Born in

1893, he was educated at Coe College and the University of Pennsylvania. He

served with the U. S. National Army, 1917-1919, A. E. F. France as a Captain

of Field Artillery. During recent years a business and financial consultant, he

was formerly a general partner of Guggenheim Brothers, New York, Mining

Investments, and prior thereto he was a vice president of Chase National Bank

and its affiliates. He is a trustee of the John Simon Guggenheim Memorial

Foundation and of the Solomon R. Guggenheim Foundation. He is also a

director of Kennecott Copper Corporation and its affiliates.

—

## Page 008

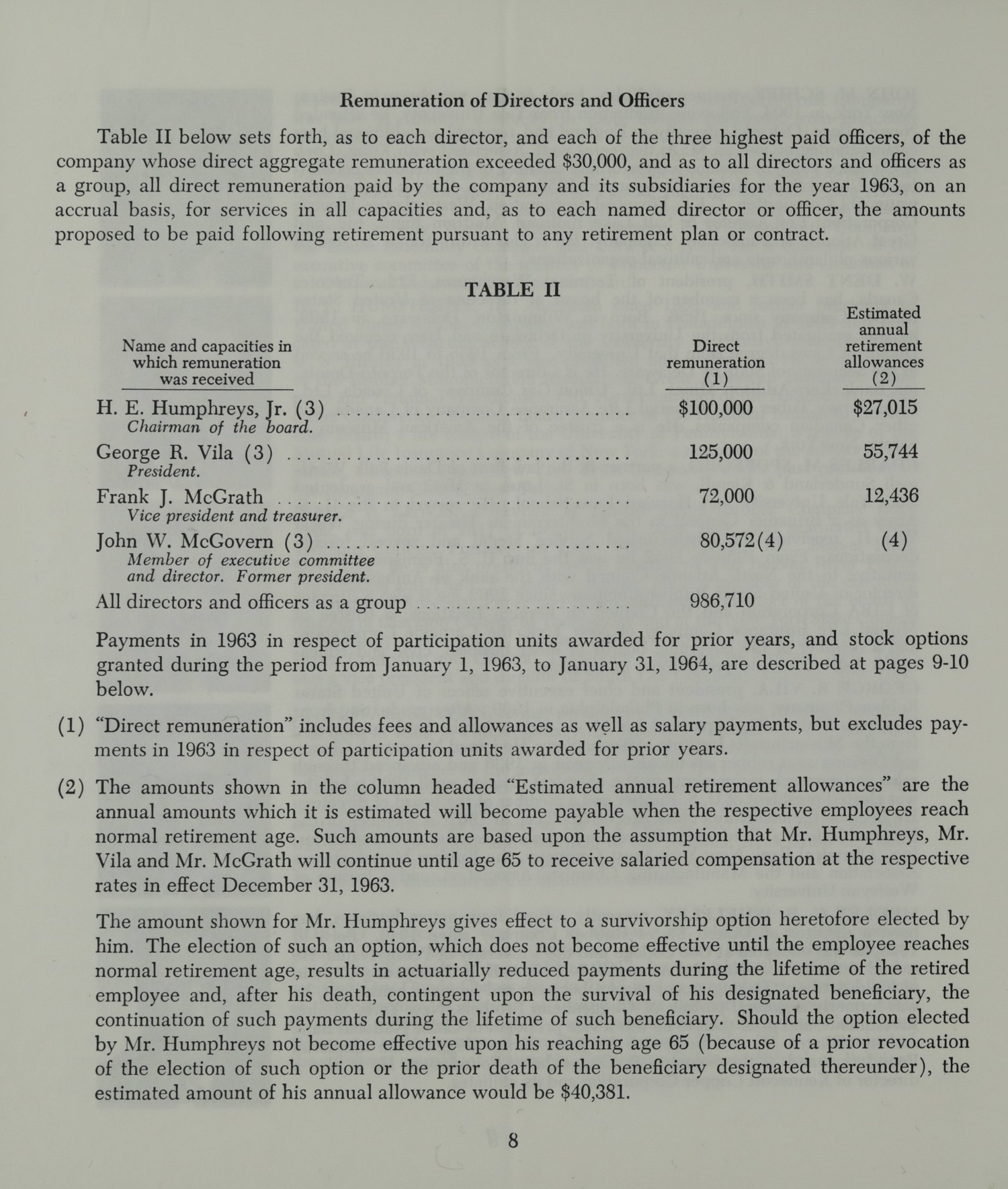

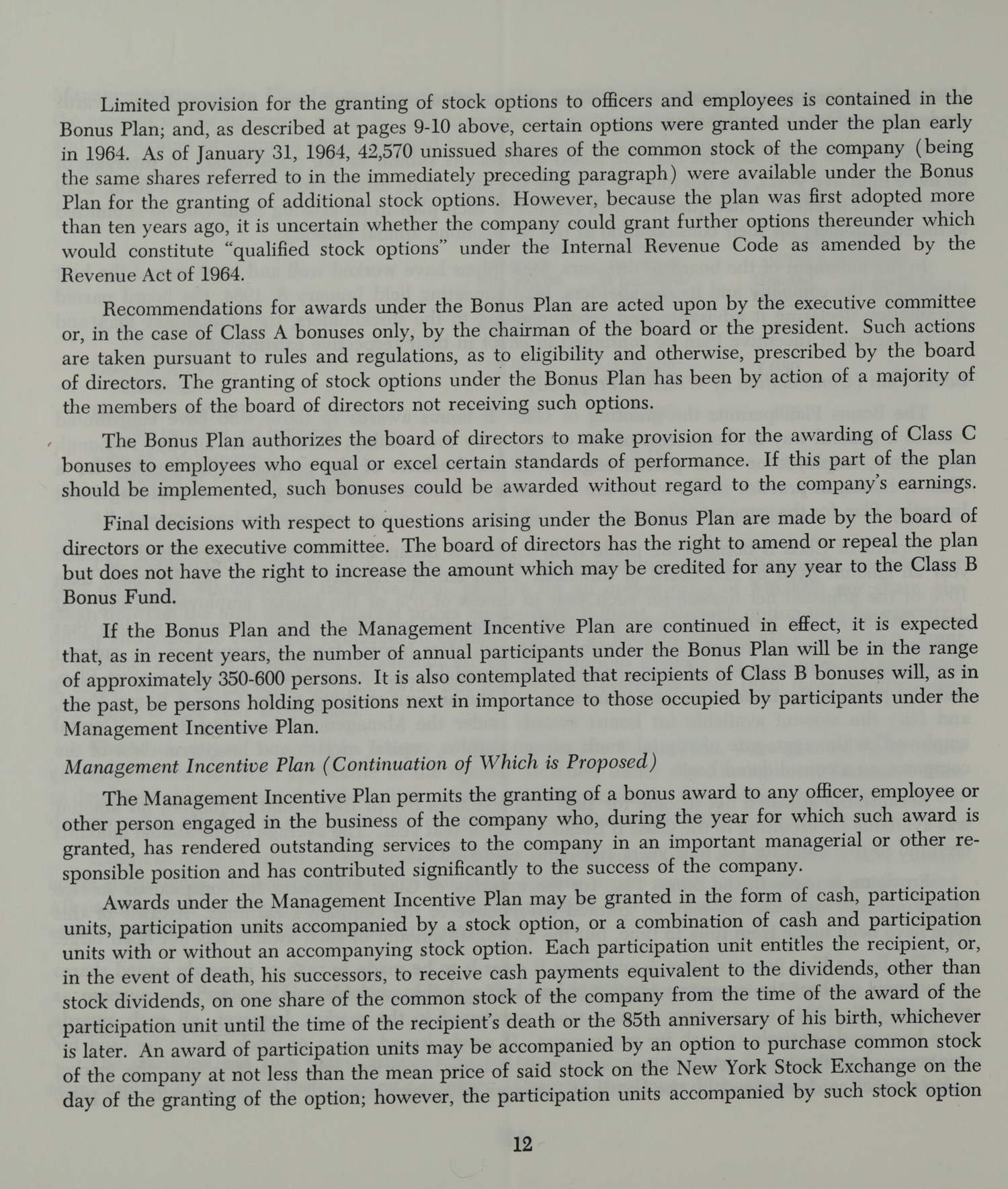

Remuneration of Directors and Officers

Table II below sets forth, as to each director, and each of the three highest paid officers, of the company whose direct aggregate remuneration exceeded $30,000, and as to all directors and officers as a group, all direct remuneration paid by the company and its subsidiaries for the year 1963, on an accrual basis, for services in all capacities and, as to each named director or officer, the amounts proposed to be paid following retirement pursuant to any retirement plan or contract.

TABLE II

Estimated

Name and capacities in Direct annual

which remuneration remuneration retirement

was received (1) allowances (2)

H. E. Humphreys, Jr. (3) $100,000 $27,015

Chairman of the board.

George R. Vila (3) 125,000 55,744

President.

Frank J. McGrath 72,000 12,436

Vice president and treasurer.

John W. McGovern (3) 80,572(4) (4)

Member of executive committee

and director. Former president.

All directors and officers as a group 986,710

Payments in 1963 in respect of participation units awarded for prior years, and stock options granted during the period from January 1, 1963, to January 31, 1964, are described at pages 9-10 below.

(1) “Direct remuneration” includes fees and allowances as well as salary payments, but excludes payments in 1963 in respect of participation units awarded for prior years.

(2) The amounts shown in the column headed “Estimated annual retirement allowances” are the annual amounts which it is estimated will become payable when the respective employees reach normal retirement age. Such amounts are based upon the assumption that Mr. Humphreys, Mr. Vila and Mr. McGrath will continue until age 65 to receive salaries compensation at the respective rates in effect December 31, 1963.

The amount shown for Mr. Humphreys gives effect to a survivorship option heretofore elected by him. The election of such an option, which does not become effective until the employee reaches normal retirement age, results in actuarially reduced payments during the lifetime of the retired employee and, after his death, contingent upon the survival of his designated beneficiary, the continuation of such payments during the lifetime of such beneficiary. Should the option elected by Mr. Humphreys not become effective upon his reaching age 65 (because of a prior revocation of the election of such option or the prior death of the beneficiary designated thereunder), the estimated amount of his annual allowance would be $40,331.

—

## Page 009

Here is the text extracted from the document image:

(3) Under the terms of employment contracts with the company, deferred contingent compensation will become payable to Mr. Humphreys and Mr. Vila, and has become payable to Mr. McGovern, over a period of years, as set forth in their respective contracts, commencing in the case of Mr. Humphreys and Mr. Vila after termination of their service with the company, and in the case of Mr. McGovern in January, 1962. In the case of Mr. Humphreys, the amount of such compensation will be $50,000 for each year of service from January 1, 1952, to December 31, 1961; in the case of Mr. Vila, the amount will be $25,000 for each year of service from January 1, 1961, until such time as his employment under his contract shall be terminated; and in the case of Mr. McGovern, the amount is $25,000 for each year of service from October 10, 1957, to October 31, 1960. As set forth in the respective contracts, payment of such compensation was made conditional upon the officer not leaving the company voluntarily or being discharged for cause and is further subject to forfeiture in the event that after termination of his service he engages in conduct prejudicial to the company or in a competing business. No other director or officer has an employment contract with the company providing for the payment of deferred compensation.

(4) The amount shown for Mr. McGovern in the column headed “Direct remuneration” includes $26,000 paid in 1963 in respect of deferred cash awards granted in prior years under the Management Incentive Plan. At the end of 1963, additional amounts in respect of a prior award under that plan were payable to Mr. McGovern, $15,370 in 1964 and in 1965, subject to forfeiture in the event of his engaging in conduct prejudicial to the company or in a competing business.

Such amount also includes a retirement allowance of $27,966 paid to Mr. McGovern in 1963 under a survivorship option elected by him. If such option had not been elected, his annual allowance would be $33,857.

The Management Incentive Plan provides for awards to employees not only in cash but also in participation units. Each participation unit entitles an employee to receive cash payments equal to the cash dividends payable on one share of the company’s common stock from the date of the award of the participation unit until the death of the employee and, in the event of the employee’s death prior to age 65, entitles his successors in interest to receive such payments until the date when the employee would have attained age 65. Awards of participation units may be accompanied by options for the purchase of shares of the company’s common stock in amounts not to exceed three shares for each participation unit, but participation units so awarded are subject to immediate cancellation pro rata upon the exercise of accompanying stock options.

No awards were made under the Management Incentive Plan for 1963. However, payments were made in 1963 in respect of participation units awarded for prior years, and stock options accompanying participation units awarded for 1962 were granted under the Management Incentive Plan on February 13, 1963. Stock options not related to participation units were granted under the Bonus Plan on January 8, 1964.

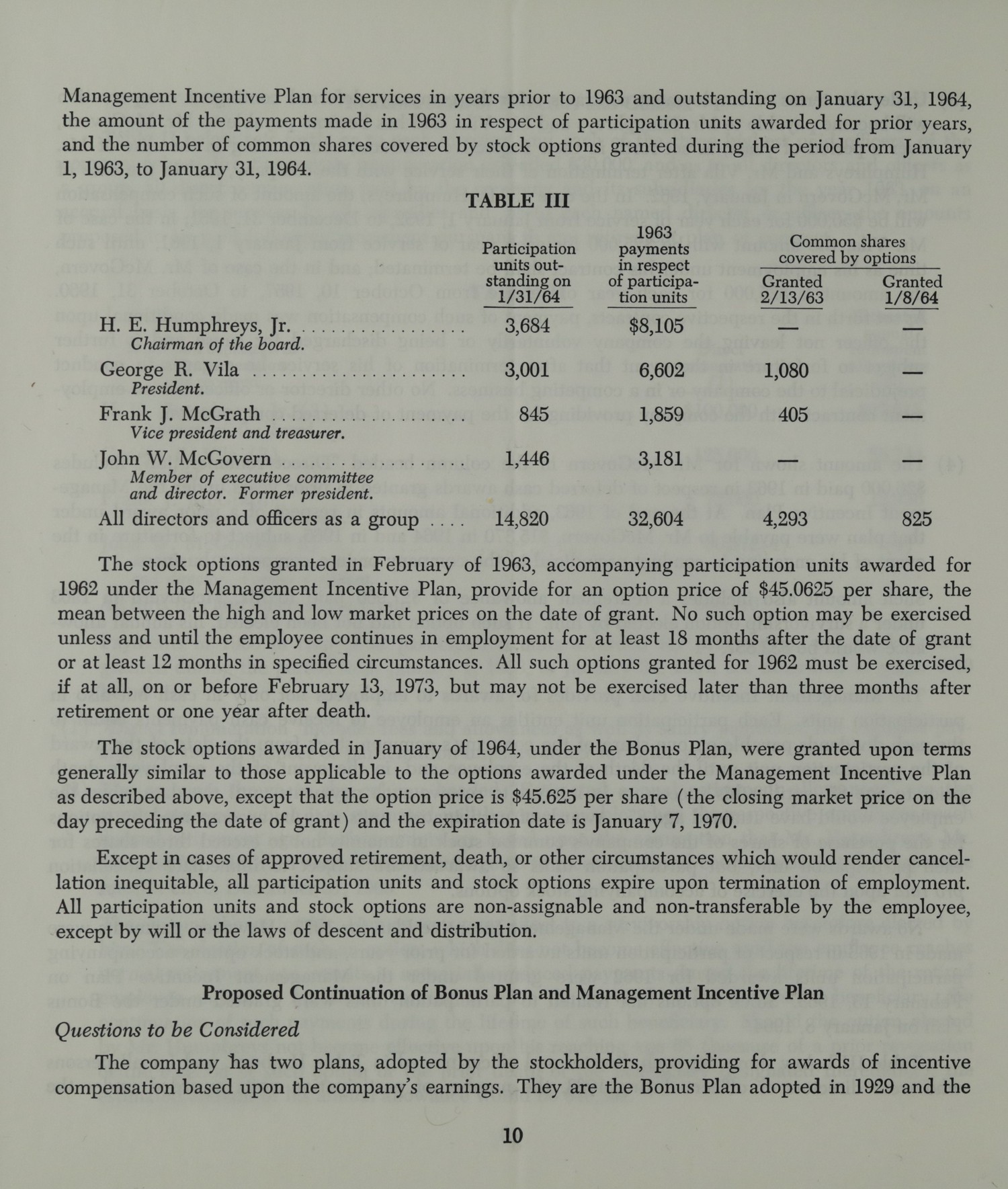

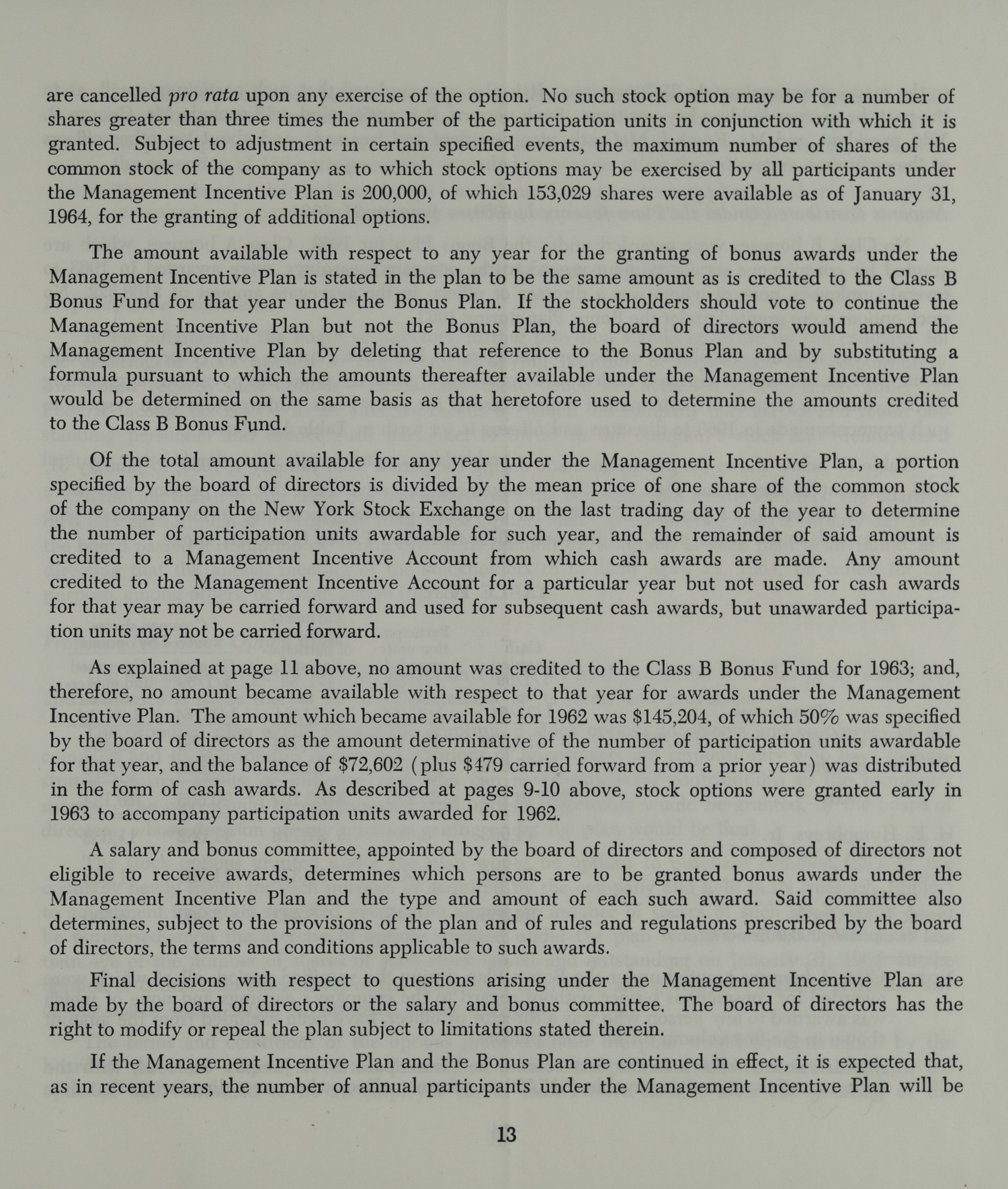

Table III below shows for each director and officer named in Table II above, and for all persons who were directors or officers during 1963, the number of participation units awarded under the Management Incentive Plan.

—

## Page 010

Management Incentive Plan for services in years prior to 1963 and outstanding on January 31, 1964, the amount of the payments made in 1963 in respect of participation units awarded for prior years, and the number of common shares covered by stock options granted during the period from January 1, 1963, to January 31, 1964.

TABLE III

Participation 1963 Common shares

units out- payments covered by options

standing on in respect Granted Granted

1/31/64 of participa- 2/13/63 1/8/64

tion units

H. E. Humphreys, Jr. . . . . . . . . . . . . . . . 3,684 $8,105 – –

Chairman of the board.

George R. Vila . . . . . . . . . . . . . . . . . . . . 3,001 6,602 1,080 –

President.

Frank J. McGrath . . . . . . . . . . . . . . . . . 845 1,859 405 –

Vice president and treasurer.

John W. McGovern . . . . . . . . . . . . . . . . 1,446 3,181 – –

Member of executive committee

and director. Former president.

All directors and officers as a group . . . 14,820 32,604 4,293 825

The stock options granted in February of 1963, accompanying participation units awarded for 1962 under the Management Incentive Plan, provide for an option price of $45.0625 per share, the mean between the high and low market prices on the date of grant. No such option may be exercised unless and until the employee continues in employment for at least 18 months after the date of grant or at least 12 months in specified circumstances. All such options granted for 1962 must be exercised, if at all, on or before February 13, 1973, but may not be exercised later than three months after retirement or one year after death.

The stock options awarded in January of 1964, under the Bonus Plan, were granted upon terms generally similar to those applicable to the options awarded under the Management Incentive Plan as described above, except that the option price is $45.625 per share (the closing market price on the day preceding the date of grant) and the expiration date is January 7, 1970.

Except in cases of approved retirement, death, or other circumstances which would render cancellation inequitable, all participation units and stock options expire upon termination of employment. All participation units and stock options are non-assignable and non-transferable by the employee, except by will or the laws of descent and distribution.

Proposed Continuation of Bonus Plan and Management Incentive Plan

Questions to be Considered

The company has two plans, adopted by the stockholders, providing for awards of incentive compensation based upon the company’s earnings. They are the Bonus Plan adopted in 1929 and the 10

—

## Page 011

Management Incentive Plan adopted in 1959. Information concerning these plans and the awards made thereunder is set forth below.

Each of the plans requires that the board of directors submit to the stockholders, at intervals of no more than five years, the question of whether the plan, in its existing form or a revised form, shall be continued in effect. That question with respect to each plan in its existing form will be submitted to the stockholders for their consideration at the forthcoming annual meeting.

In the judgment of the board of directors, these plans have worked well and have served the best interests of the company and its stockholders. At its meeting held January 8, 1964, the board passed a resolution declaring it advisable, and recommending to the stockholders, that the Bonus Plan and the Management Incentive Plan be continued in effect in their respective existing forms.

Bonus Plan (Continuation of Which is Proposed)

The Bonus Plan permits the granting of Class B bonus awards to those who have contributed most in a general way to the success of the company by their ability, industry and loyalty. Although any officer, employee or other person engaged in the business of the company may qualify for a Class B bonus, in practice such awards are not made to persons participating under the Management Incentive Plan for the same period.

Awards of Class B bonuses are made from a Class B Bonus Fund to which is credited for each year an amount fixed by the board of directors. Such amount for any year may not be more than 10% of the adjusted net income for such year in excess of 6% of the capital employed during that year. “Adjusted net income” for any year is the company’s consolidated net income, (a) less that portion of such income representing earnings retained, after income taxes, in respect of the amount determinative of the number of participation units awardable under the Management Incentive Plan, and (b) plus (i) the interest on long-term debt, (ii) the amount credited to the Class B Bonus Fund, and (iii) the amount available for bonus awards under the Management Incentive Plan. “Capital employed” is the aggregate of capital stock, earned surplus, capital surplus and long-term debt of the company, on a consolidated basis.

Because the adjusted net income for 1963 was less than 6% of the capital employed, no amount was available for crediting to the Class B Bonus Fund for that year. The average of the annual amounts credited to that fund for the four years 1959-1962 was $763,622.

Provision is made in the Bonus Plan for the granting of Class A bonuses for conspicuous service of any nature. Such awards may be granted irrespective of the company’s earnings. Awards of this type have been made from time to time, but the aggregate amount of such awards has not been large.

The Bonus Plan permits Class A and Class B awards to be made in cash or in newly issued shares of common stock of the company (42,570 shares having been available for issue for this purpose as of January 31, 1964) or in shares of such stock purchased in the market; however, all such awards have been made entirely in cash for many years. If newly issued shares of stock should be used for this purpose in the future, such shares could not be issued at prices less than 66-2/3% of the market value thereof as determined by the board of directors in accordance with the provisions of the plan.

—

## Page 012

Limited provision for the granting of stock options to officers and employees is contained in the Bonus Plan; and, as described at pages 9-10 above, certain options were granted under the plan early in 1964. As of January 31, 1964, 42,570 unissued shares of the common stock of the company (being the same shares referred to in the immediately preceding paragraph) were available under the Bonus Plan for the granting of additional stock options. However, because the plan was first adopted more than ten years ago, it is uncertain whether the company could grant further options thereunder which would constitute “qualified stock options” under the Internal Revenue Code as amended by the Revenue Act of 1964.

Recommendations for awards under the Bonus Plan are acted upon by the executive committee or, in the case of Class A bonuses only, by the chairman of the board or the president. Such actions are taken pursuant to rules and regulations, as to eligibility and otherwise, prescribed by the board of directors. The granting of stock options under the Bonus Plan has been by action of a majority of the members of the board of directors not receiving such options.

The Bonus Plan authorizes the board of directors to make provision for the awarding of Class C bonuses to employees who equal or excel certain standards of performance. If this part of the plan should be implemented, such bonuses could be awarded without regard to the company’s earnings.

Final decisions with respect to questions arising under the Bonus Plan are made by the board of directors or the executive committee. The board of directors has the right to amend or repeal the plan but does not have the right to increase the amount which may be credited for any year to the Class B Bonus Fund.

If the Bonus Plan and the Management Incentive Plan are continued in effect, it is expected that, as in recent years, the number of annual participants under the Bonus Plan will be in the range of approximately 350-600 persons. It is also contemplated that recipients of Class B bonuses will, as in the past, be persons holding positions next in importance to those occupied by participants under the Management Incentive Plan.

Management Incentive Plan (Continuation of Which is Proposed)

The Management Incentive Plan permits the granting of a bonus award to any officer, employee or other person engaged in the business of the company who, during the year for which such award is granted, has rendered outstanding services to the company in an important managerial or other responsible position and has contributed significantly to the success of the company.

Awards under the Management Incentive Plan may be granted in the form of cash, participation units, participation units accompanied by a stock option, or a combination of cash and participation units with or without an accompanying stock option. Each participation unit entitles the recipient, or, in the event of death, his successors, to receive cash payments equivalent to the dividends, other than stock dividends, on one share of the common stock of the company from the time of the award of the participation unit until the time of the recipient’s death or the 85th anniversary of his birth, whichever is later. An award of participation units may be accompanied by an option to purchase common stock of the company at not less than the mean price of said stock on the New York Stock Exchange on the day of the granting of the option; however, the participation units accompanied by such stock option

—

## Page 013

are cancelled pro rata upon any exercise of the option. No such stock option may be for a number of shares greater than three times the number of the participation units in conjunction with which it is granted. Subject to adjustment in certain specified events, the maximum number of shares of the common stock of the company as to which stock options may be exercised by all participants under the Management Incentive Plan is 200,000, of which 153,029 shares were available as of January 31, 1964, for the granting of additional options.

The amount available with respect to any year for the granting of bonus awards under the Management Incentive Plan is stated in the plan to be the same amount as is credited to the Class B Bonus Fund for that year under the Bonus Plan. If the stockholders should vote to continue the Management Incentive Plan but not the Bonus Plan, the board of directors would amend the Management Incentive Plan by deleting that reference to the Bonus Plan and by substituting a formula pursuant to which the amounts thereafter available under the Management Incentive Plan would be determined on the same basis as that heretofore used to determine the amounts credited to the Class B Bonus Fund.

Of the total amount available for any year under the Management Incentive Plan, a portion specified by the board of directors is divided by the mean price of one share of the common stock of the company on the New York Stock Exchange on the last trading day of the year to determine the number of participation units awardable for such year, and the remainder of said amount is credited to a Management Incentive Account from which cash awards are made. Any amount credited to the Management Incentive Account for a particular year but not used for cash awards for that year may be carried forward and used for subsequent cash awards, but unawarded participation units may not be carried forward.

As explained at page 11 above, no amount was credited to the Class B Bonus Fund for 1963, and, therefore, no amount became available with respect to that year for awards under the Management Incentive Plan. The amount which became available for 1962 was $145,204, of which 50% was specified by the board of directors as the amount determinative of the number of participation units awardable for that year, and the balance of $72,602 (plus $479 carried forward from a prior year) was distributed in the form of cash awards. As described at pages 9-10 above, stock options were granted early in 1963 to accompany participation units awarded for 1962.

A salary and bonus committee, appointed by the board of directors and composed of directors not eligible to receive awards, determines which persons are to be granted bonus awards under the Management Incentive Plan and the type and amount of each such award. Said committee also determines, subject to the provisions of the plan and of rules and regulations prescribed by the board of directors, the terms and conditions applicable to such awards.

Final decisions with respect to questions arising under the Management Incentive Plan are made by the board of directors or the salary and bonus committee. The board of directors has the right to modify or repeal the plan subject to limitations stated therein.

If the Management Incentive Plan and the Bonus Plan are continued in effect, it is expected that, as in recent years, the number of annual participants under the Management Incentive Plan will be substantially the same as the number of annual participants under the Bonus Plan.

—

## Page 014

in the range of approximately 35-70 persons. It is also contemplated that such participants will, as in the past, be persons holding key positions. Such persons, it is anticipated, will include Mr. George R. Vila, president, and Mr. Frank J. McGrath, vice president and treasurer, and about ten other officers of the company.

Amounts Distributed Under the Plans January 1, 1959, to January 31, 1964

No Class B bonuses were awarded under the Bonus Plan for 1963. Class A bonuses, which are granted for conspicuous service without regard to the company’s earnings, were awarded in 1963 to several employees, none of whom was a director or officer, in the aggregate amount of $108,522. No stock options were granted under the Bonus Plan during 1963.

The only amounts distributed under the Management Incentive Plan for 1963 (except for install-ments paid on account of deferred cash awards previously granted) were the payments, aggregating $55,169, made in respect of participation units awarded for prior years. Information with respect to such payments made in 1963 to directors and officers is set forth in Table III above.

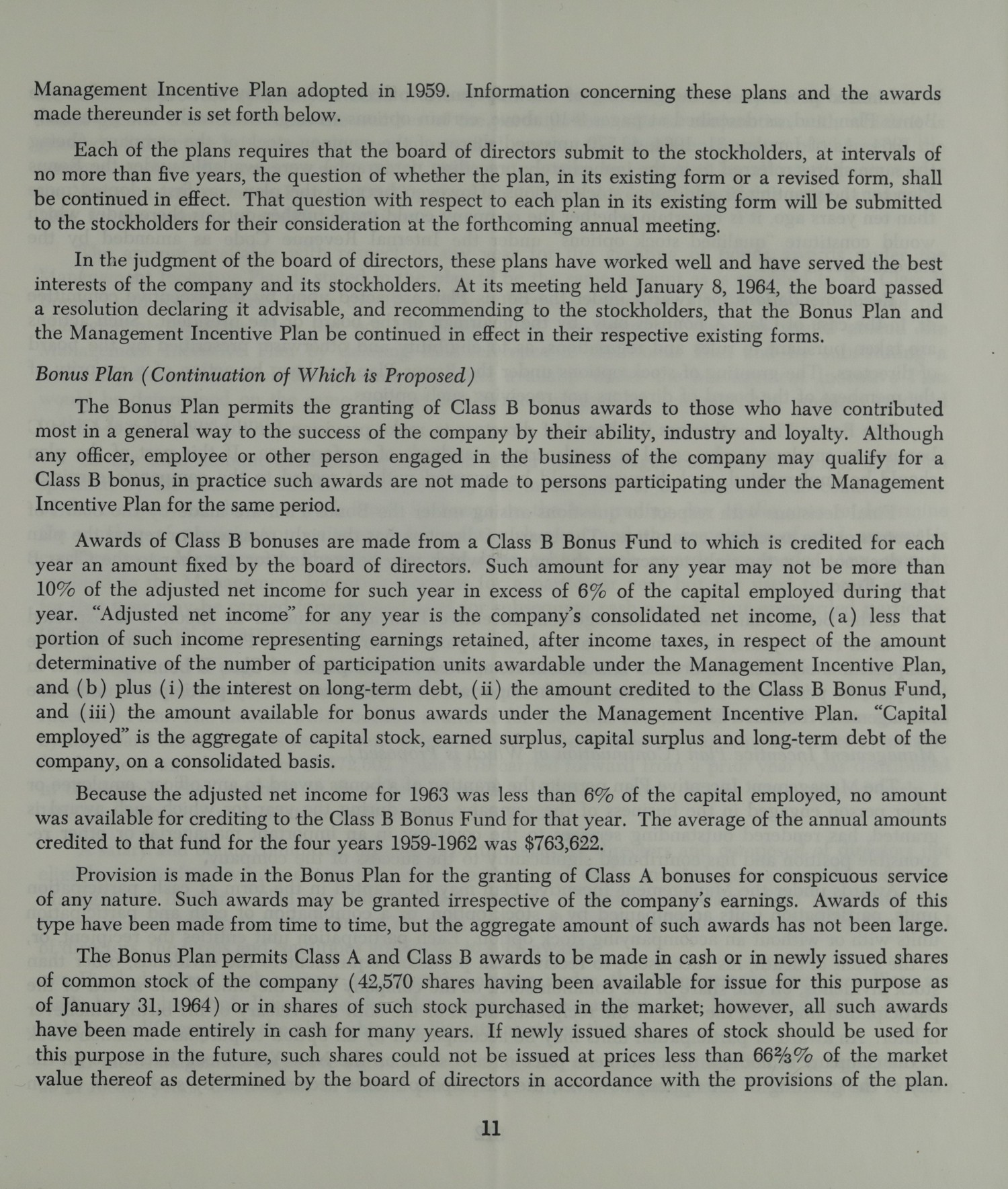

Table IV below shows the provisions made during the period from January 1, 1959, to January 31, 1964, pursuant to the Bonus Plan and the Management Incentive Plan, for all persons who were directors or officers as of January 31, 1964, for all other persons (including former officers) who received awards under either plan, and for each officer named in Tables II and III above.

TABLE IV

Cash Participa- Payments Common shares

awarded tion units in respect covered by options

Distributees 1/1/59 awarded of participa- Granted Unexpired

to 1/1/59 to tion units 1/1/59 and unexer-

1/31/64 1/31/64 1/1/59 to cised on

1/31/64 1/31/64

Directors and officers as of 1/31/64 … $ 610,600 14,143 $ 96,514 55,156 58,161

All other persons ………………….. 4,105,588 11,070 83,593 35,539 17,973

$4,716,188 25,213 $180,107 90,695 76,134

H. E. Humphreys, Jr. ………………. $ 74,093 3,684 $ 27,718 11,052 11,052

Chairman of the Board.

George R. Vila ……………………. 70,868 3,001 19,371 11,888 11,888

President.

Frank J. McGrath ………………….. 32,066 845 5,443 3,960 4,560

Vice president and treasurer.

NOTE: Class A bonuses granted under the Bonus Plan during the specified period, all of which were awarded for conspicuous service without regard to the company’s earnings and none of which was awarded to any person who was a director or officer, have been excluded from the amount shown in the first column for all other persons.

All cash awards shown in the first column had been paid as of January 31, 1964, with the exception of two amounts payable ($15,370 to a former officer who was a director on that date.

—

## Page 015

and $2,690 to another person) in respect of deferred cash awards previously granted under the Management Incentive Plan.

All participation units shown in the second column were outstanding on January 31, 1964, with the exception of 136 units previously awarded to persons other than directors and officers.

The numbers of shares shown in the last column include, where applicable, shares covered by unexpired and unexercised options granted under the Bonus Plan in 1958.

Proposed Adoption of 1964 Stock Option Plan

Proposal to be Considered

In the judgment of the board of directors, further provision should be made by the company for the granting of stock options to employees occupying positions of importance and responsibility. The board regards such options — particularly those which are accorded special status under the Federal income tax laws — as an effective means by which the company may attract and retain outstanding personnel and induce such personnel to invest in the company’s stock and identify their interests more closely with those of the stockholders.

Believing that it would serve the best interests of the company and its stockholders, the board of directors has formulated a proposed 1964 Stock Option Plan. At its meeting held February 12, 1964, the board passed a resolution declaring that in its opinion the adoption of such plan is advisable, and directing that the annual meeting of the stockholders to be held April 21, 1964, be called for the purpose, among others, of taking action thereon.

Proposed 1964 Stock Option Plan

The text of the proposed 1964 Stock Option Plan is set forth in Exhibit A to this proxy statement, and reference is made thereto for a full statement of its terms and provisions.

The proposed plan would permit the granting of stock options to officers and employees of the company and its subsidiaries occupying positions of importance and responsibility who have demonstrated unusual ability or initiative and who can make significant contributions to the company’s success. The plan would be administered, and options thereunder would be granted, by the board of directors, whose decision on any question arising under the plan would be final.

The stock options granted under the plan would be options to purchase common stock of the company newly issued for such purpose or acquired by the company and held in its treasury. Subject to adjustment in certain specified events, the aggregate number of shares of such stock which could be purchased upon the exercise of options granted under the plan would be 200,000, which is less than 4% of the number of shares of such stock issued and outstanding on January 31, 1964. In the opinion of counsel, no stockholder of the company would have any preemptive right to purchase any of the shares which might be optioned under the plan.

The terms and conditions of the options granted under the plan would be determined by the board of directors subject to certain limitations. No such option would be exercisable until the optionee had continued to be an employee for at least twelve months after the granting of the

—

## Page 016

option or be transferable by the optionee except by will or the laws of descent and distribution.

The maximum term of any such option would be five years, and the minimum option price would be the fair market value (or, if higher, the par value) of the optioned stock at the time of the granting of the option. On January 31, 1964, the fair market value of the common stock of the company (taken as the mean between the high and low prices of said stock on the New York Stock Exchange) was $47.125 per share.

The proposed plan would become effective on April 21, 1964, and would continue in effect until recalled or abolished. The board of directors would have the right to amend the plan subject to limitations stated therein.

It is expected that options under the plan would be granted upon the terms and conditions required for “qualified stock options” under Section 422(b) of the Internal Revenue Code as amended by the Revenue Act of 1964. Under the applicable provisions of said code, if the company grants an employee a “qualified stock option” specifying an option price not less than the fair market value of the optioned stock at the time of grant, and if the recipient exercises the option without having ceased to be an employee of the company or any of its subsidiaries at any time during the period from the grant of the option until three months before its exercise, and if no disposition of the stock transferred to the recipient upon exercise of the option is made by him within the three-year period beginning the day after such stock is so transferred, then, no taxable income will result at the time of the transfer of the stock to the recipient upon his exercise of the option, and any profit realized by the recipient from a sale or exchange of the stock (after the three-year holding period mentioned above) will be treated as a capital gain, and no deduction will be allowable at any time to the company with respect to the stock transferred to the recipient upon his exercise of the option.

No determination has yet been made as to the identity of the employees to whom options would be granted or as to the number of shares which would be optioned to any one person. The plan would permit more than one option to be granted to an employee, but in the aggregate not more than 6% of the shares available under the plan could be optioned to any one person.

Of the persons named in the Tables set forth above, only Messrs. H. E. Humphreys, Jr., George R. Vila and Frank J. McGrath, who are officers of the company, and Mr. James E. Lewis, who is an officer of a subsidiary, could qualify for options under the plan. No director, unless also an employee as defined in the plan, would be eligible.

Right of Appraisal of Dissenting Stockholders

Section 14:9-3 of the General Corporation Law of New Jersey provides that, if a corporation shall adopt a plan providing for the issue of new stock, any stockholder holding stock issued before April 15, 1920, not voting in favor of the plan, may obtain an appraisal of the market value of his stock, and the corporation thereafter shall pay to him the appraised value of such stock and the stock shall be transferred to the corporation. Any holder of such stock, wishing to avail himself of the right afforded by this statute upon the adoption of the proposed 1964 Stock Option Plan, must (a) give the company written notice of his dissent prior to the vote on the adoption of said plan at the forthcoming stock-

—

## Page 017

holders’ meeting, and (b) apply to the Superior Court in New Jersey within thirty days after such stockholders’ meeting, on reasonable notice to the company, for the appointment of three disinterested appraisers. The statute requires the charges and expenses of such appraisers and appraisal to be paid by the corporation. The statute also provides that the corporation may elect to permit the dissenting stockholder to subscribe for his proportionate share of the new stock to be issued. No further notice will be given by the company to any stockholder as to the dates prior to which actions must be taken by the stockholder to perfect rights under said Section 14:9-3.

Required Vote and Recommendation of Board of Directors

The question concerning the Bonus Plan and the question concerning the Management Incentive Plan will be submitted to the stockholders at the forthcoming annual meeting in the form of separate resolutions that each such plan be continued in effect. The proposal concerning the 1964 Stock Option Plan will be submitted at said meeting in the form of a resolution that such plan, as set forth in Exhibit A to this proxy statement, be adopted.

The presence in person or by proxy of the holders of one-third of all the shares of the capital stock of the company is required for a quorum at the meeting. The favorable vote of two-thirds in interest of each class of stockholders present in person or by proxy and voting at the meeting is required for the adoption of each of said resolutions.

The board of directors recommends a vote “FOR” continuing the Bonus Plan in effect, a vote “FOR” continuing the Management Incentive Plan in effect, and a vote “FOR” adopting the proposed 1964 Stock Option Plan as set forth in Exhibit A hereto.

New York, New York

March 17, 1964

—

## Page 019

IV. Stock to be Optioned

A. The stock options granted under this Plan shall be options to purchase shares of the common stock of the Company.

B. The stock delivered upon the exercise of any stock option granted under this Plan may be common stock newly issued for such purpose, or common stock acquired by the Company and held in its treasury, or partly such newly issued stock and partly such acquired stock.

C. Subject to the provision for adjustments contained in Article VI hereof, the aggregate number of shares of common stock which may be purchased upon the exercise of stock options granted under this Plan, excluding the number of shares covered by options which shall have expired or otherwise shall have become unexercisable, shall not exceed 200,000.

D. Not more than 6% of the aggregate number of shares of common stock referred to in Section C of this Article IV may be made subject to the stock option or options granted under this Plan to a single employee.

V. Terms and Conditions of Options

A. The terms and conditions applicable to the stock options granted under this Plan, which need not be the same in all cases, shall be determined by the Board of Directors subject to the following limitations:

1. The term of any stock option granted under this Plan shall not exceed five years from the date of its grant.

2. The option price for the common stock covered by any stock option granted under this Plan shall in no case be less than the par value of said stock, as stated in the Company’s Amended Certificate of Organization, or less than the fair market value of said stock at the time of the granting of such option, as determined by the Board of Directors; provided, however, that this limitation shall be subject to the provision for adjustments contained in Article VI hereof. For purposes of determining the fair market value of said common stock at the time of the granting of any such stock option, the Board of Directors may, if it so elects, assume such fair market value to be the mean between the high and low prices of said stock on the New York Stock Exchange on the day of the granting of such option or, if no sale of said stock shall be made on said Exchange on said day, on the next preceding day on which any such sale shall have been made.

3. No stock option granted under this Plan shall (a) be exercisable unless and until the optionee shall have continued to be an employee for a period of not less than twelve months following the date of the grant of such option, (b) be transferable or assignable by the optionee otherwise than by will or the laws of descent and distribution, or (c) be exercisable during the lifetime of the optionee except by him.

B. The Board of Directors may at any time, in the light of then existing laws and regulations, modify the terms and conditions applicable to any stock option theretofore granted under this Plan.

—

## Page 020

UNIROYAL CHEM-texts

Vol. 1 PUBLISHED FOR THE PEOPLE OF UNIROYAL CHEMICAL No. 2

URW STRIKE ENDS AFTER 97 DAYS

PACT IS COSTLIEST IN OUR HISTORY

The longest and costliest strike in the 75-year history of the Company is over. Company and union negotiators reached an accord at 9:30 p.m. on July 26. The agreement between Uniroyal and the United Rubber Workers is the largest settlement ever reached by the company. Its total cost including wage increases, pensions, insurance and other benefits is more than 50 cents per hour — a 6 per cent increase each year for a total of 18 per cent over the three-year length of the contract.

Eachstriking employee lost an average of 14 weeks of pay. They also borrowed some of their vacation money in 1968 to pay for the cost, to say nothing of the interest lost on savings accounts or cashing in savings bonds to pay daily expenses.

The company saw its profits disappear in the second quarter of the year because of the fixed costs which continue without the benefit of offsetting production. Second quarter earnings had been at a record $14,309,000 during the strike. This year, because of the strike, they were $15,551,000 less or $12,753,000. Before taxes, the loss was more than $25,000,000. The strike also hit home at the company’s sales force, many of whom were without goods to sell. Salesmen were told good customers would never be able to get their merchandise long and specialized long and seriously on how they were going to get their back once the strike was over.

It is no wonder that the end brought a continuous state of relief which was echoed throughout all plant and branch offices. A tire salesman overheard out of the company’s huge Los Angeles branch put it tersely. “Tell those people back at the plants to get going! I need quality merchandise quickly if I’m going to get back those customers I lost.”

EMPLOYEE PUBLICATION NAMED

The Naugatuck Chemical employee newsletter has a new name – “Chem Texts”. It was selected from over 100 entries by the plant staff with an assist from the Public Relations department. “Chem Texts” was selected as the result of a suggestion made by Sal Lantiere of the Physical Testing Laboratory. It was one of four entries by Sal who received a $25.00 savings bond for his idea.

Second prize of a $15.00 gift certificate at the company store was won by Mary Regan of the Physical Testing Laboratory for her entry — “Chemtext”. Third prize of a $10.00 gift certificate was awarded to Doug Jones of the Rubber Compounding laboratory for his entry — “Chemesyn”.

A second group of the name “Chemesyn” was received from Mary Raby, wife of Harold Raby of the Synthetic Processing Department. However, her entry was dated after the winning entry was selected.

We wish to congratulate the winners and thank everyone who entered the contest.

MR. & MRS. JACK MALA RETIRE

Marie and Jack Mala retired from the company on September 8 with a combined total of 52 years of company service between them. They are the second couple to retire together in a year. Marie retired from the Raw Stock department with 21 and one-half years of service. Jack has been with us for 30 and one half years and retired from the Reclaim Production department.

EMPLOYEES URGED TO JOIN OUR PAYROLL SAVINGS PLAN IN SEPTEMBER BOND DRIVE

Employees who are in our payroll savings plan, or who join this year, will be able to purchase new Treasury “Freedom Shares” which earn 4.75 per cent when held to maturity, according to Thomas J. Kiernan, manager of personnel relations at “1230”.

He emphasized that Freedom Shares can be purchased in limited amounts by each plan participant during the “September Bond Drive”.

Savings bonds and Freedom Shares are not only investments that return a high rate of interest but are also of enormous benefit to the country, Mr. Kiernan said. “I urge everyone not enrolled in our payroll savings plan to sign up during our September enrollment drive. Our goal is to have at least 50 per cent of all employees participating in the plan.”

Chemical plant employees will be contacted during the drive and the advantages of buying savings bonds and Freedom Shares under the payroll savings plans will be explained to them.

MARY REGAN

DOUG JONES

Above: Contest winner Sal Lantiere of the Physical Testing Laboratory in #112 building. Sal has spent all of his 22 years with the company in the laboratory section.

ANNUAL BLOODMOBILE VISIT

On August 23 the Red Cross Bloodmobile came to the Chemical plant visit. Vacations and other scheduling problems reduced the number of available donors so we only 122 pints were collected against our 150 pint quota. However, the shortage of donors did not mean we did not wish to postpone the visit any longer. Those of you who were unable to give this time can donate to the Beacon Falls community visit in October or the next June 12 annual visit will give us another chance to regain our ideal 175 pints per visit.

An honor roll of all of those who gave will be posted throughout the plant. We wish to congratulate late Alan Woodruff who received a one-gallon pin and Louis Schuller who received a two-gallon pin and all those new and old who contributed to this visit.

SAL LANTIERE WINS CONTEST

—

## Page exhibit-a

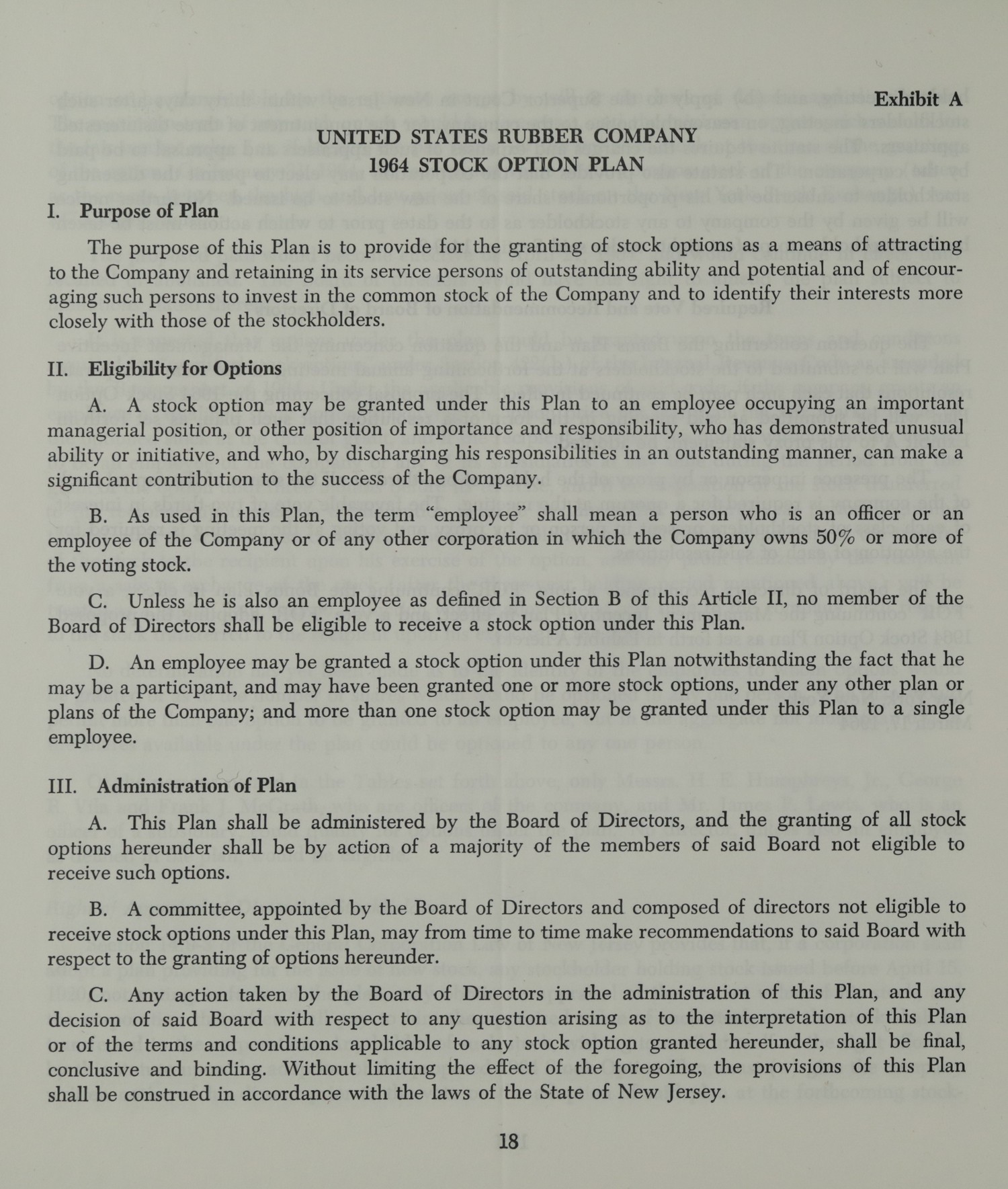

UNITED STATES RUBBER COMPANY

1964 STOCK OPTION PLAN

I. Purpose of Plan

The purpose of this Plan is to provide for the granting of stock options as a means of attracting to the Company and retaining in its service persons of outstanding ability and potential and of encouraging such persons to invest in the common stock of the Company and to identify their interests more closely with those of the stockholders.

II. Eligibility for Options

A. A stock option may be granted under this Plan to an employee occupying an important managerial position, or other position of importance and responsibility, who has demonstrated unusual ability or initiative, and who, by discharging his responsibilities in an outstanding manner, can make a significant contribution to the success of the Company.

B. As used in this Plan, the term “employee” shall mean a person who is an officer or an employee of the Company or of any other corporation in which the Company owns 50% or more of the voting stock.

C. Unless he is also an employee as defined in Section B of this Article II, no member of the Board of Directors shall be eligible to receive a stock option under this Plan.

D. An employee may be granted a stock option under this Plan notwithstanding the fact that he may be a participant, and may have been granted one or more stock options, under any other plan or plans of the Company; and more than one stock option may be granted under this Plan to a single employee.

III. Administration of Plan

A. This Plan shall be administered by the Board of Directors, and the granting of all stock options hereunder shall be by action of a majority of the members of said Board not eligible to receive such options.

B. A committee, appointed by the Board of Directors and composed of directors not eligible to receive stock options under this Plan, may from time to time make recommendations to said Board with respect to the granting of options hereunder.

C. Any action taken by the Board of Directors in the administration of this Plan, and any decision of said Board with respect to any question arising as to the interpretation of this Plan or of the terms and conditions applicable to any stock option granted hereunder, shall be final, conclusive and binding. Without limiting the effect of the foregoing, the provisions of this Plan shall be construed in accordance with the laws of the State of New Jersey.

—