## Page cover

72nd Annual Report 1963

United States Rubber Company

—

## Page contents

Contents

page 2 Financial Briefs

3 Letter to Stockholders

5 Expansion Program

14 Financial Review

16 Balance Sheet

18 Income and Retained Earnings

19 Financial Notes

21 Accountants’ Opinion

22 Twenty-year Summary

24 Products

25 Directors and Officers

72nd Annual Report . . . Year Ended December 31, 1963

United States Rubber Company

1230 AVENUE OF THE AMERICAS, NEW YORK, N.Y. 10020

General Attorneys . . . . . ARTHUR, DRY, KALISH,

TAYLOR & WOOD

General Counsel . . . . . . MYRON KALISH

Associate General Counsel . . NELSON P. TAYLOR

Auditors . . . . . . . . . . HASKINS & SELLS

Trustee-Registrar

(25% Debentures – Both Issues)

MANUFACTURERS HANOVER TRUST COMPANY

40 WALL STREET, NEW YORK, N.Y. 10015

Transfer and Dividend Paying Agent

(Common and Preferred Stocks)

BANKERS TRUST COMPANY

16 WALL STREET, NEW YORK, N.Y. 10015

Registrar (Common and Preferred Stocks)

Paying Agent (25% Debentures – Both Issues)

CHEMICAL BANK NEW YORK TRUST COMPANY

20 PINE STREET, NEW YORK, N.Y. 10015

Annual Meeting of Stockholders

10:30 A.M., Tuesday, April 21, 1964

Theater of the Barbizon-Plaza Hotel

106 Central Park South

New York City

—

## Page 002

Here is the text extracted from the document image, preserving the layout and structure as much as possible:

United States Rubber Company and Subsidiary Companies

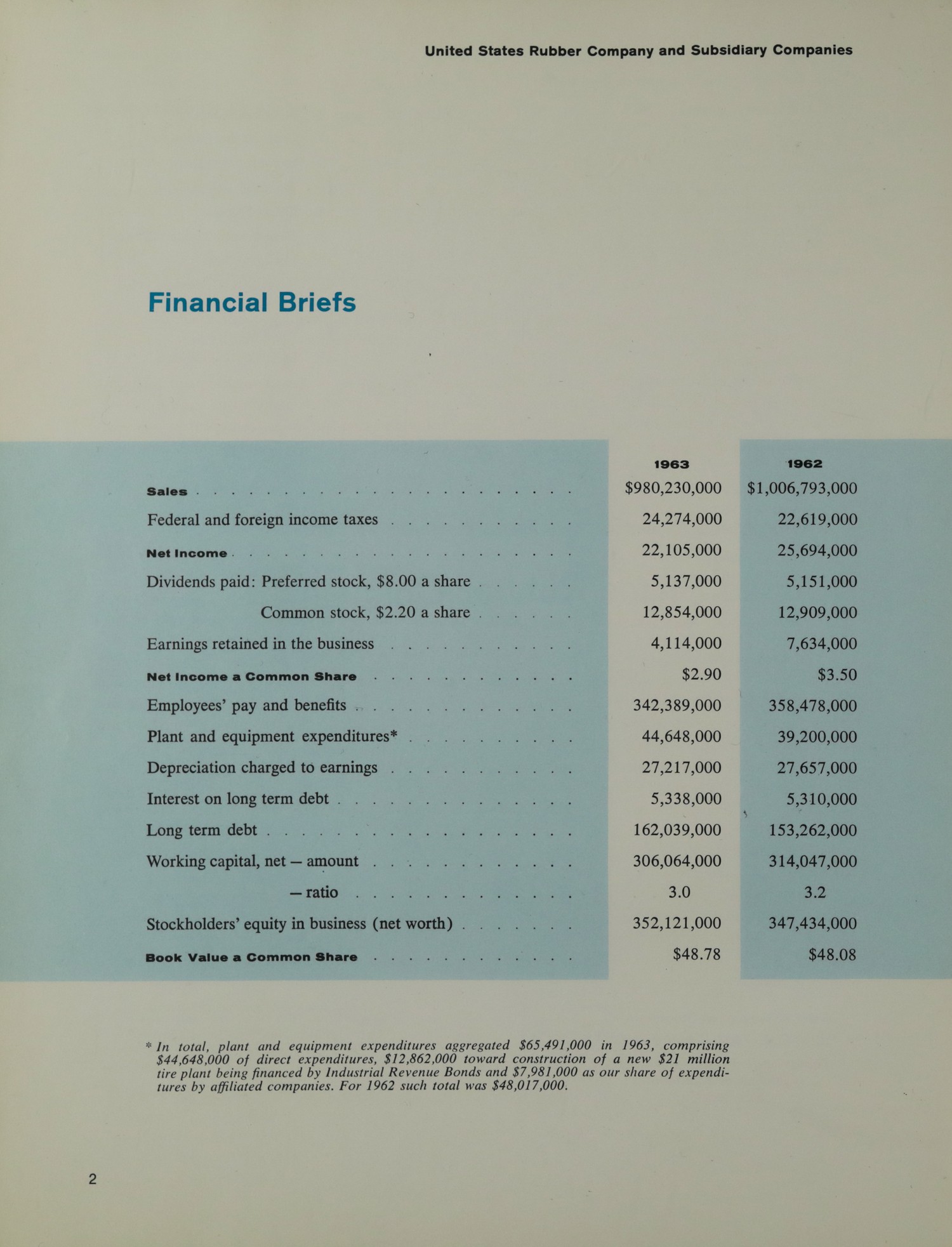

Financial Briefs

1963 1962

Sales . . . . . . . . . . . . . . . . . . $980,230,000 $1,006,793,000

Federal and foreign income taxes . . . . . . . 24,274,000 22,619,000

Net Income. . . . . . . . . . . . . . . . . 22,105,000 25,694,000

Dividends paid: Preferred stock, $8.00 a share . 5,137,000 5,151,000

Common stock, $2.20 a share . . 12,854,000 12,909,000

Earnings retained in the business . . . . . . . 4,114,000 7,634,000

Net Income a Common Share . . . . . . . . . . $2.90 $3.50

Employees’ pay and benefits . . . . . . . . . 342,389,000 358,478,000

Plant and equipment expenditures* . . . . . . 44,648,000 39,200,000

Depreciation charged to earnings . . . . . . . 27,217,000 27,657,000

Interest on long term debt . . . . . . . . . . 5,338,000 5,310,000

Long term debt . . . . . . . . . . . . . . . 162,039,000 153,262,000

Working capital, net — amount . . . . . . . . 306,064,000 314,047,000

— ratio . . . . . . . . . . 3.0 3.2

Stockholders’ equity in business (net worth) . . 352,121,000 347,434,000

Book Value a Common Share . . . . . . . . . . $48.78 $48.08

* In total, plant and equipment expenditures aggregated $65,491,000 in 1963, comprising $44,648,000 of direct expenditures, $12,862,000 toward construction of a new $21 million tire plant being financed by Industrial Revenue Bonds and $7,981,000 as our share of expenditures by affiliated companies. For 1962 such total was $48,017,000.

—

## Page 003

Here is the text extracted from the document image, preserving the layout and structure as much as possible:

February 12, 1964

To the Stockholders of United States Rubber Company:

In the first half of 1963 our profit rose 2.7 per cent, despite 1.4 per cent lower sales. But strikes in nine plants during the second half of the year reduced net income for the year to $22,105,000, or 14 per cent below 1962.

Our 1963 sales of $980,230,000 were second highest in our history, but 2.6 per cent below the record high of $1,006,793,000 set in 1962. Sales increased, however, in many product categories and in several cases set new records.

The strikes, which prevented sales from exceeding the 1962 record, lasted for varying periods of time at three chemical and synthetic rubber plants, a plastic plant, a Canadian footwear plant and four of our five domestic tire plants.

Strike issues varied from place to place but in the longest and costliest strikes at our tire plants the most important issue was the Company’s need to revise loose work practices which had evolved during the war and post-war years and which had prevented the Company from making full use of its expensive manufacturing equipment. New contracts signed at these plants will improve our position and provide long range security in the interest of stockholders and employes alike.

Capital expenditures for new plants and the modernization of existing ones reached a new level of approximately 65 million dollars, compared with 48 million in 1962. These figures include our direct capital expenditures, the expenditure at our new tire plant in Alabama and our share of investment in joint ventures and affiliated companies. Outside the U.S. A., new investments included a plastics plant in Italy, a footwear plant in Spain, a rubber company in Australia and both a tire and chemical venture in Japan.

This new level of capital expenditures strengthens our profit potential for the future. It is a part of a 300-million-dollar long term expansion and modernization program, the largest in the Company’s history, which is described on the following pages.

The Company made new strides in distribution of its products, particularly tires. Many new tire dealers took on the U. S. Royal franchise because of the outstanding quality of our tires and the new merchandising techniques we have developed. We moved strongly into many shopping centers. In areas where we could not obtain suitable independent dealers, we continued to supplement our distribution by opening Company tire centers. We now have a total of 228 Company-owned tire distribution outlets.

In research and development, a number of new products were put into production. In addition, we committed several million dollars for plants to manufacture new products starting in 1964. Among these are Royalene – our new ethylene-propylene rubber – a new dyeable polypropylene fiber, and Expanded Royalite – a new plastic material now coming into use in auto body parts, truck cabs, house trailers, and a host of other products. Gratifying progress was made in the development of a new high speed, super performance tire based on Royalene rubber.

We completed the second full year of use of our CVC bonding agent in tires. This development and other advances allowed us to move into a position of leadership in tire quality and performance. Late in the year, we completed construction of a new tire proving ground on a 6,900-acre tract in Laredo, Texas. This is by far the most advanced of any tire testing facility in the world today and will insure our maintaining product leadership.

By order of the Board of Directors,

[Handwritten signatures]

President

Chairman

—

## Page 004

Here is the text extracted from the document image, preserving the layout and structure as much as possible:

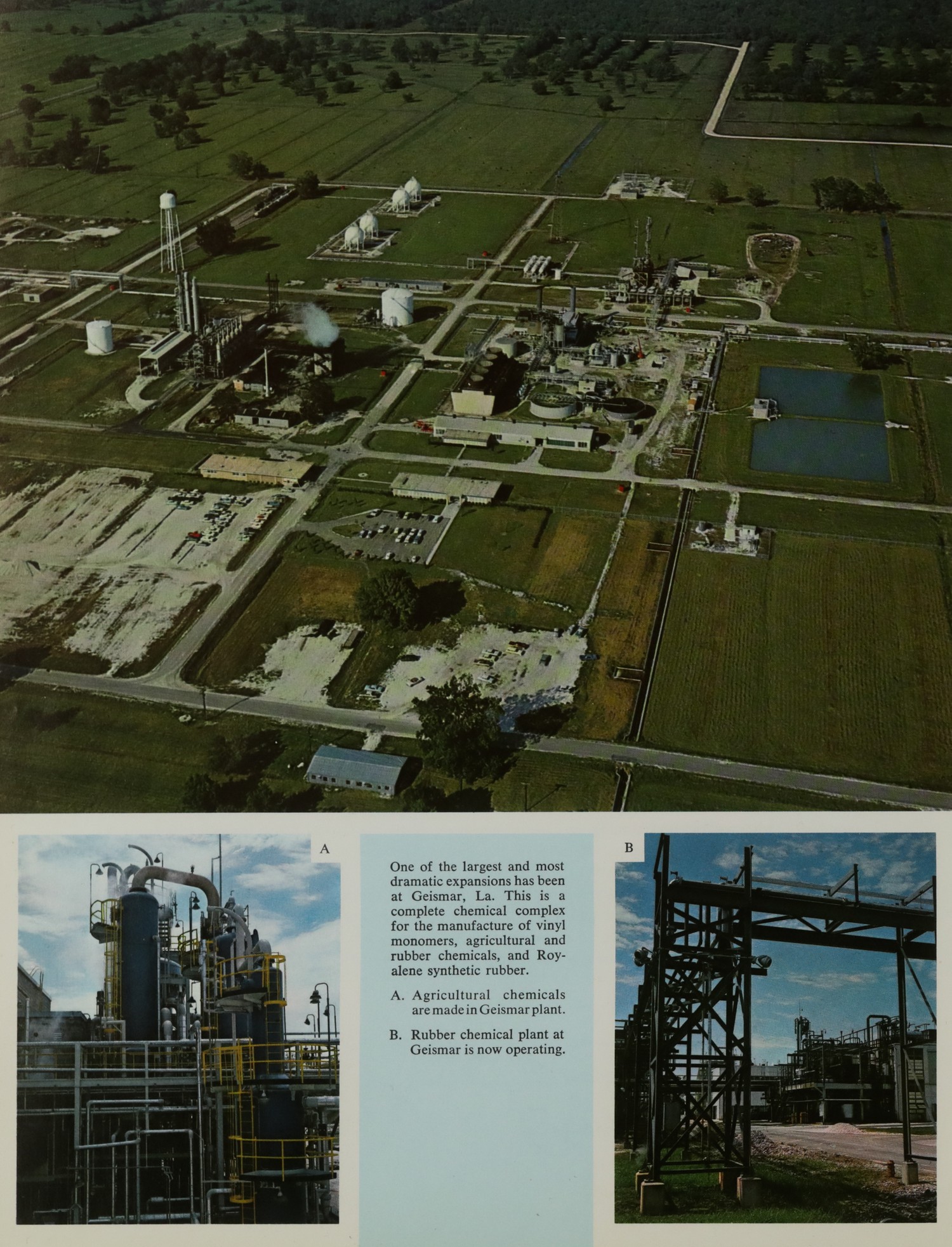

One of the largest and most dramatic expansions has been at Geismar, La. This is a complete chemical complex for the manufacture of vinyl monomers, agricultural and Rydene synthetic rubber.

A. Agricultural chemicals are made in Geismar plant.

B. Rubber chemical plant at Geismar is now operating.

—

## Page 005

$300,000,000 Expansion and Modernization Program

U. S. Rubber has undertaken a world-wide expansion and modernization program which will involve a total investment of more than 300 million dollars. We are well along in this program and expect it to be completed in three to four years. Approximately 200 million of this program is for the modernization and expansion of our tire production and distribution facilities, both in the United States and abroad and for chemical, textile and synthetic rubber plants which supply raw materials and components to our tire manufacturing operations. The remainder of the program will provide the other manufacturing divisions of the company with new facilities in the United States, Europe, Latin America, Australia, the Far East and Canada devoted to products other than tires and tire components. The program will open new markets for us at home and abroad, and will strengthen our competitive position in the more profitable areas of our business.

New Chemical Complex

At Geismar, La. we have invested more than 30 million dollars in a modern chemical complex, and our investments there will continue to increase in the future. Three plants are now in operation. One is producing vinyl monomers for use in plastics. Another is producing agricultural chemicals, and a third is turning out improved rubber and agricultural chemicals. This spring a fourth plant will start making Royalene, the new ethylene-propylene synthetic rubber.

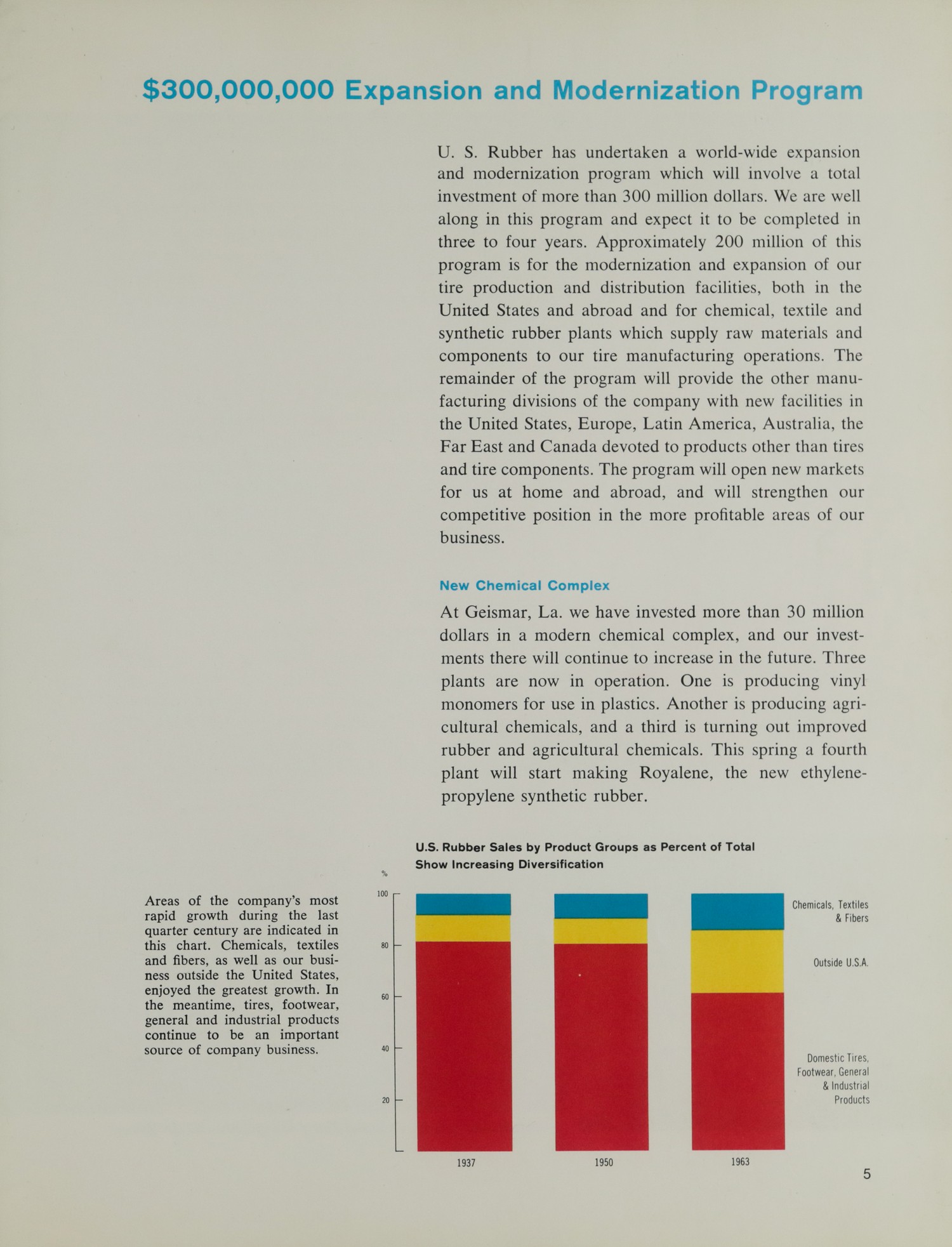

U.S. Rubber Sales by Product Groups as Percent of Total Show Increasing Diversification

Areas of the company’s most rapid growth during the last quarter century are indicated in this chart. Chemicals, textiles and fibers, as well as our business outside the United States, enjoyed the greatest growth. In the meantime, tires, footwear, general and industrial products continue to be an important source of company business.

—

## Page 006

Geismar is also the site selected for Rubicon Chemicals, Inc., a company jointly owned with Imperial Chemical Industries, Ltd. of Great Britain. It will produce aniline and tolylene diisocyanates for polyurethane synthetics, used in foams, rubbers and surface coatings.

In Scotts Bluff, La. we are doubling our capacity for Kralastic ABS plastics. These tough plastics are widely used in automobile dashboards, body parts and panels, and also in travel trailers. They also find wide applications in appliances, pipe, telephone hand sets and a host of other uses.

Most Modern Tire Plant in U.S.A.

The most modern and efficient tire plant in the industry recently started production in Opelika, Ala. to satisfy the rapidly growing tire market of the southeastern states. An intensive modernization program is also in progress in our other tire plants. We have also opened new tread rubber plants in Conyers, Georgia and Wilkes-Barre, Pennsylvania, and others are now in the planning stage.

Argentine Project

Production is expected to get underway by midyear at San Lorenzo in Argentina by PASA, an industrial complex in which we have a 24 per cent interest. It will produce synthetic rubbers, chemicals, carbon black and other hydrocarbon materials. The principal market for these products will be the thriving Argentine tire industry, but this market can be extended throughout Latin America.

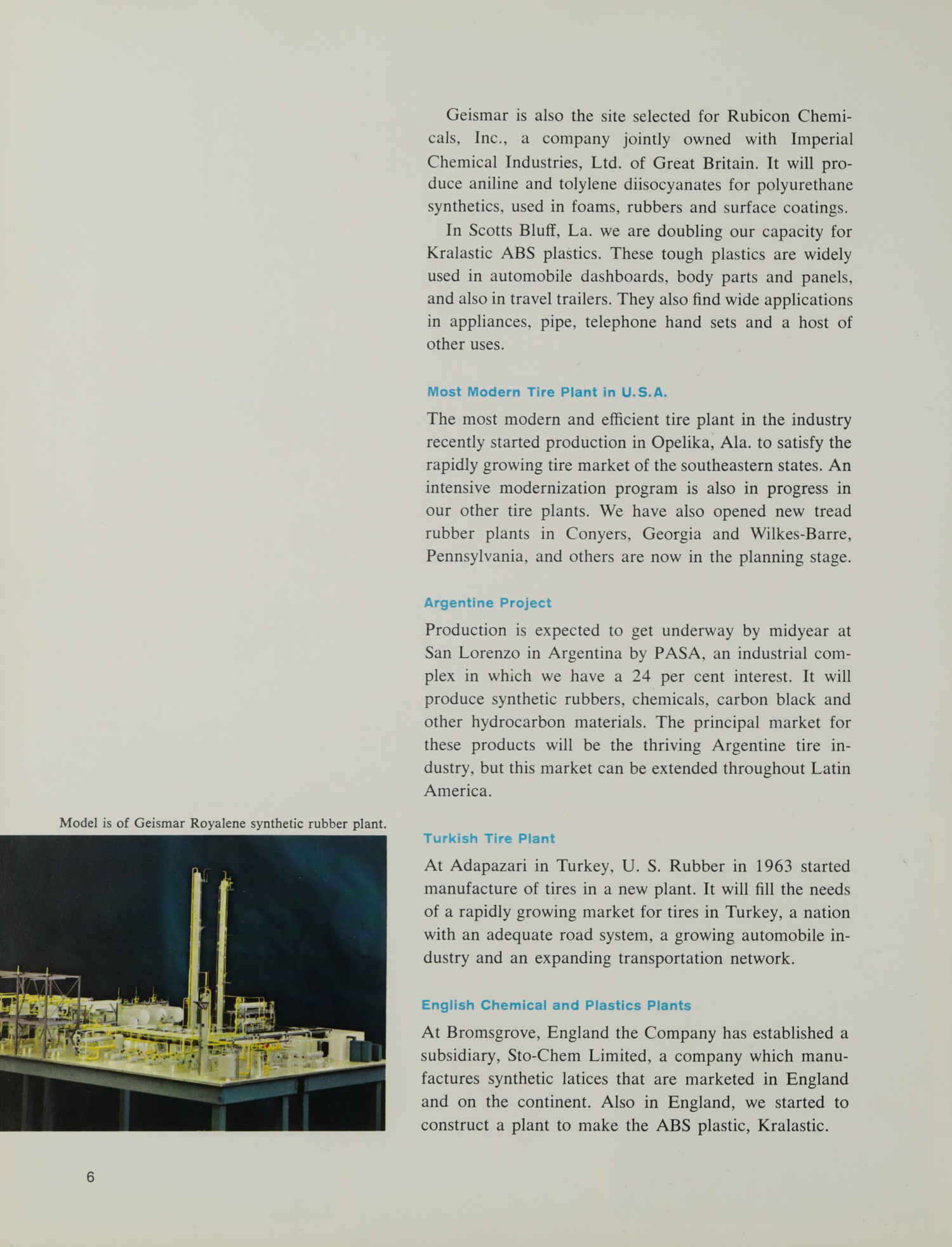

Model is of Geismar Royalene synthetic rubber plant.

Turkish Tire Plant

At Adapazari in Turkey, U. S. Rubber in 1963 started manufacture of tires in a new plant. It will fill the needs of a rapidly growing market for tires in Turkey, a nation with an adequate road system, a growing automobile industry and an expanding transportation network.

English Chemical and Plastics Plants

At Bromsgrove, England the Company has established a subsidiary, Sto-Chem Limited, a company which manufactures synthetic latices that are marketed in England and on the continent. Also in England, we started to construct a plant to make the ABS plastic, Kralastic.

—

## Page 007

Opelika, Ala. tire plant, now in production, is the most modern in industry.

—

## Page 008

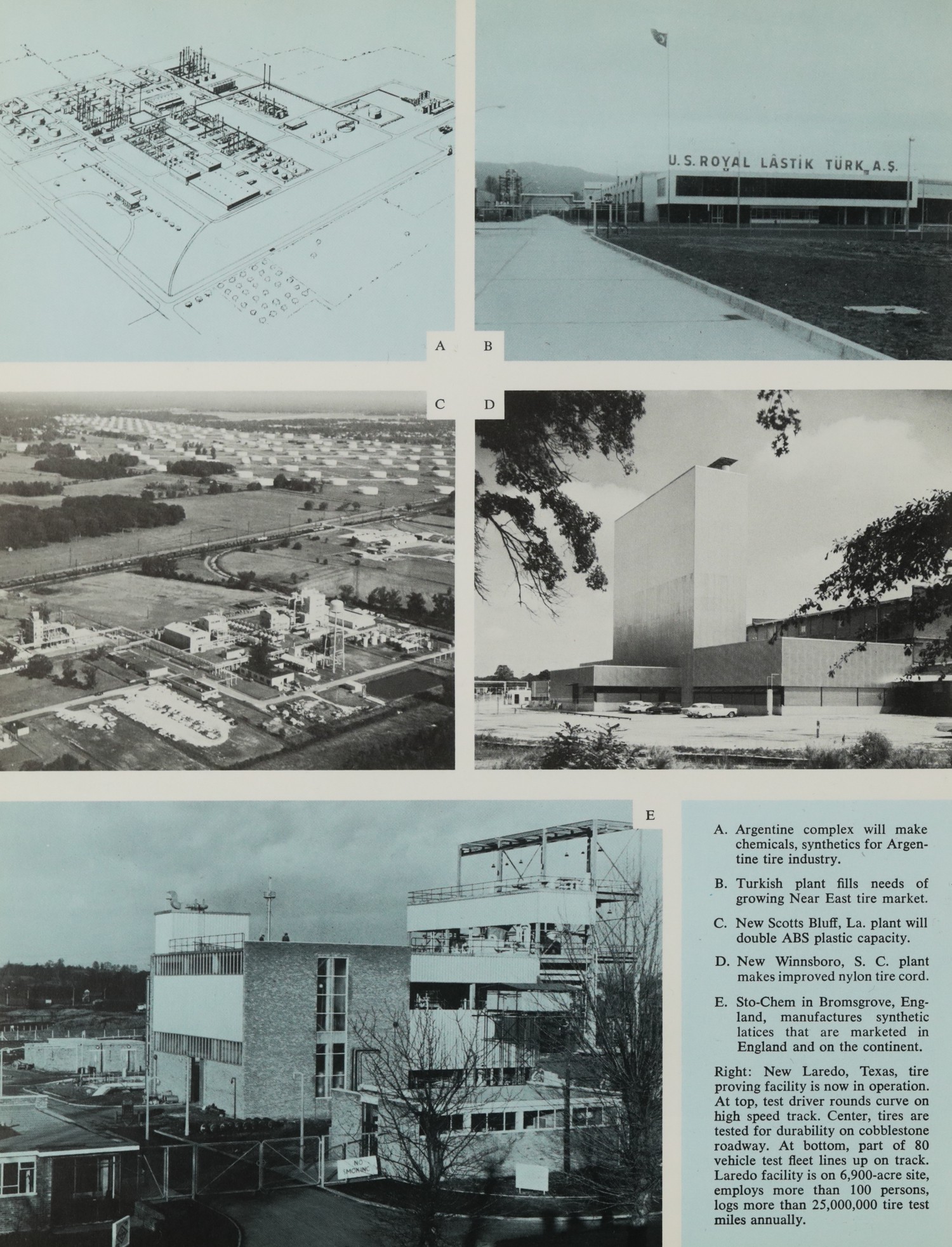

A. Argentine complex will make chemicals, synthetics for Argentine tire industry.

B. Turkish plant fills needs of growing Near East tire market.

C. New Scotts Bluff, La. plant will double ABS plastic capacity.

D. New Winnsboro, S. C. plant makes improved nylon tire cord.

E. Sto-Chem in Bromsgrove, England, manufactures synthetic latices that are marketed in England and on the continent.

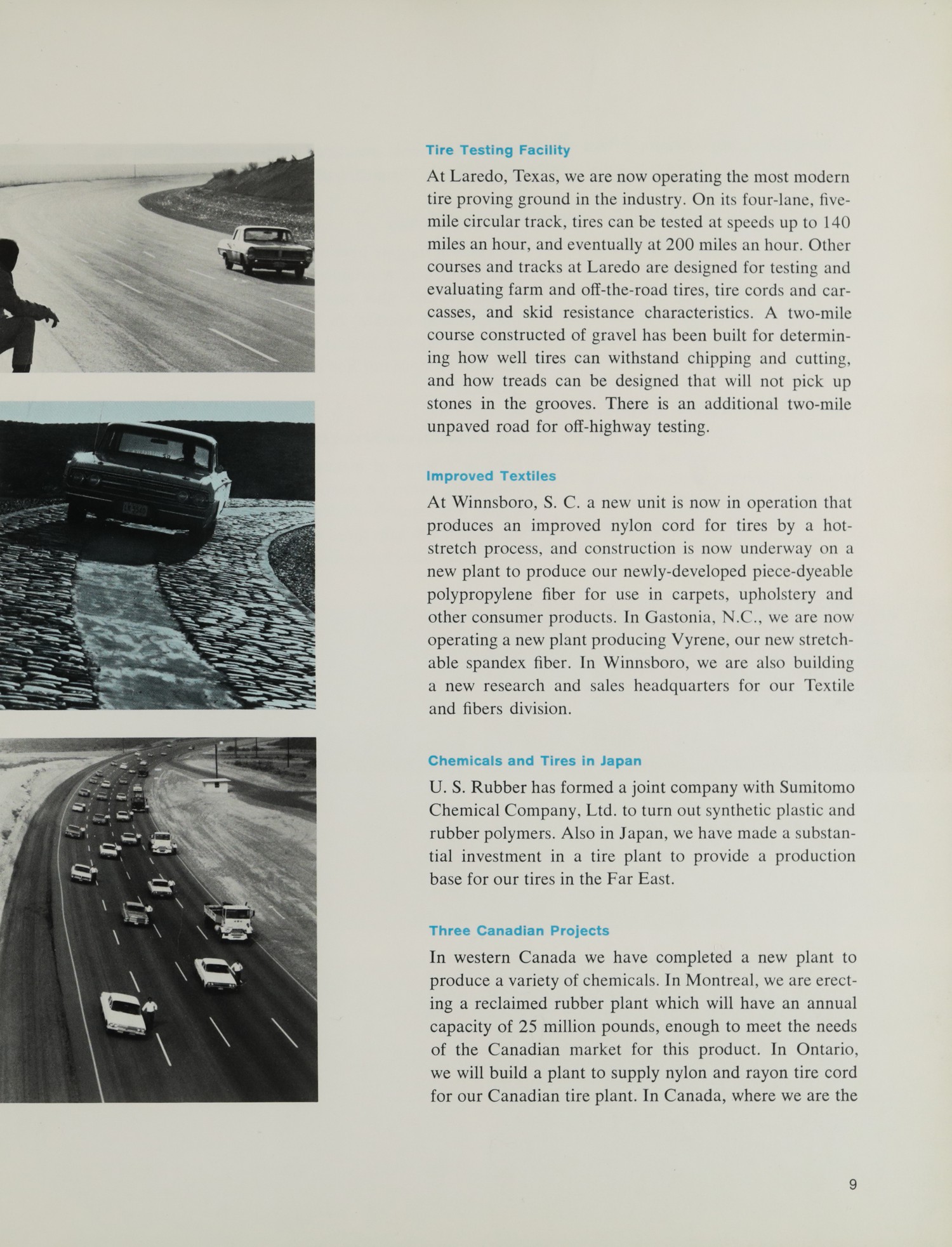

Right: New Laredo, Texas, tire proving facility is now in operation. At top, test driver rounds curve on high speed track. Center, tires are tested for durability on cobblestone roadway. At bottom, part of 80 vehicle test fleet lines up on track. Laredo facility is on 6,900-acre site, employs more than 100 persons, logs more than 25,000,000 tire test miles annually.

U.S. ROYAL LASTIK TURK A.S.

—

## Page 009

Tire Testing Facility

At Laredo, Texas, we are now operating the most modern tire proving ground in the industry. On its four-lane, five-mile circular track, tires can be tested at speeds up to 140 miles an hour, and eventually at 200 miles an hour. Other courses and tracks at Laredo are designed for testing and evaluating farm and off-the-road tires, tire cords and carcasses, and skid resistance characteristics. A two-mile course constructed of gravel has been built for determining how well tires can withstand chipping and cutting, and how treads can be designed that will not pick up stones in the grooves. There is an additional two-mile unpaved road for off-highway testing.

Improved Textiles

At Winnsboro, S. C. a new unit is now in operation that produces an improved nylon cord for tires by a hot-stretch process, and construction is now underway on a new plant to produce our newly-developed piece-dyeable polypropylene fiber for use in carpets, upholstery and other consumer products. In Gastonia, N.C., we are now operating a new plant producing Yvrone, our new stretchable spandex fiber. In Winnsboro, we are also building a new research and sales headquarters for our Textile and fibers division.

Chemicals and Tires in Japan

U.S. Rubber has formed a joint company with Sumitomo Chemical Company, Ltd. to turn out synthetic plastic and rubber polymers. Also in Japan, we have made a substantial investment in a tire plant to provide a production base for our tires in the Far East.

Three Canadian Projects

In western Canada we have completed a new plant to produce a variety of chemicals. In Montreal, we are erecting a reclaimed rubber plant which will have an annual capacity of 25 million pounds, enough to meet the needs of the Canadian market for this product. In Ontario, we will build a plant to supply nylon and rayon tire cord for our Canadian tire plant. In Canada, where we are the leading manufacturer of tires, we continue to expand and modernize our facilities.

—

## Page 010

largest and most diversified rubber company, our tire,

footwear and chemical business continues to expand.

Two Plants in Italy

At Turin in Italy we have a 50 per cent interest in Naugatuck-Rumianica, a producer of rubber and agricultural

chemicals, and other products that are sold throughout

the Common Market. In Milan, U. S. Rubber has acquired a majority interest in Rub-Co-Plast, a company

that will produce our line of coated fabrics and Royalite

products.

Information Center to Cut Costs

First of a series of management information and data

processing centers is nearing completion at Naugatuck,

Conn. The center’s modern electronic data processing

equipment will help speed such management functions as

purchasing, sales forecasting, production planning, inven-

A

B

C

D

—

## Page 011

Here is the text extracted from the document image, preserving the layout and structure as much as possible:

tory control, traffic and accounting, and is expected to

provide important savings in costs.

New Technical Center

A technical sales service center is now operating at

Naugatuck, Conn. There, in a new and modern building

more than 100 scientists, engineers and technicians provide technical services to customers who use our chemical, rubber and plastic products.

Tire Plant in Common Market

In Liége, Belgium we are constructing a new plant which

will be the most efficient tire producing unit in Europe

and will replace an obsolete tire plant we now have in

Liége. It will place us in a favorable position to compete

in the Common Market. We also operate tire plants in

Aachen, West Germany; Clairôix, France; and in Edinburgh, Scotland.

A. New Canadian plant in Edmonton,

Alberta, produces chemicals.

B. Italian plastics plant now manufactures coated fabric line.

C. Italian plant makes rubber chemicals

for the Common Market.

D. U. S. Rubber has made investment in

Japanese tire factory.

E. Information center at Naugatuck is

first of several such centers to be built

in United States. Electronic equipment

quickly processes information here to

increase efficiency and reduce costs.

F. New technical service center is in full

operation at Naugatuck, Conn. Here

100 scientists, engineers and technicians serve Naugatuck’s customers.

—

## Page 012

A. New Belgian tire plant will serve the Benelux market.

B. Synthetic rubber will be made in new Painesville, Ohio plant.

C. Australian investment will include new tire factory.

D. Reclaimed rubber plant in Montreal will meet Canadian market needs.

E. Spanish footwear plant is our first investment in Spain.

—

## Page 013

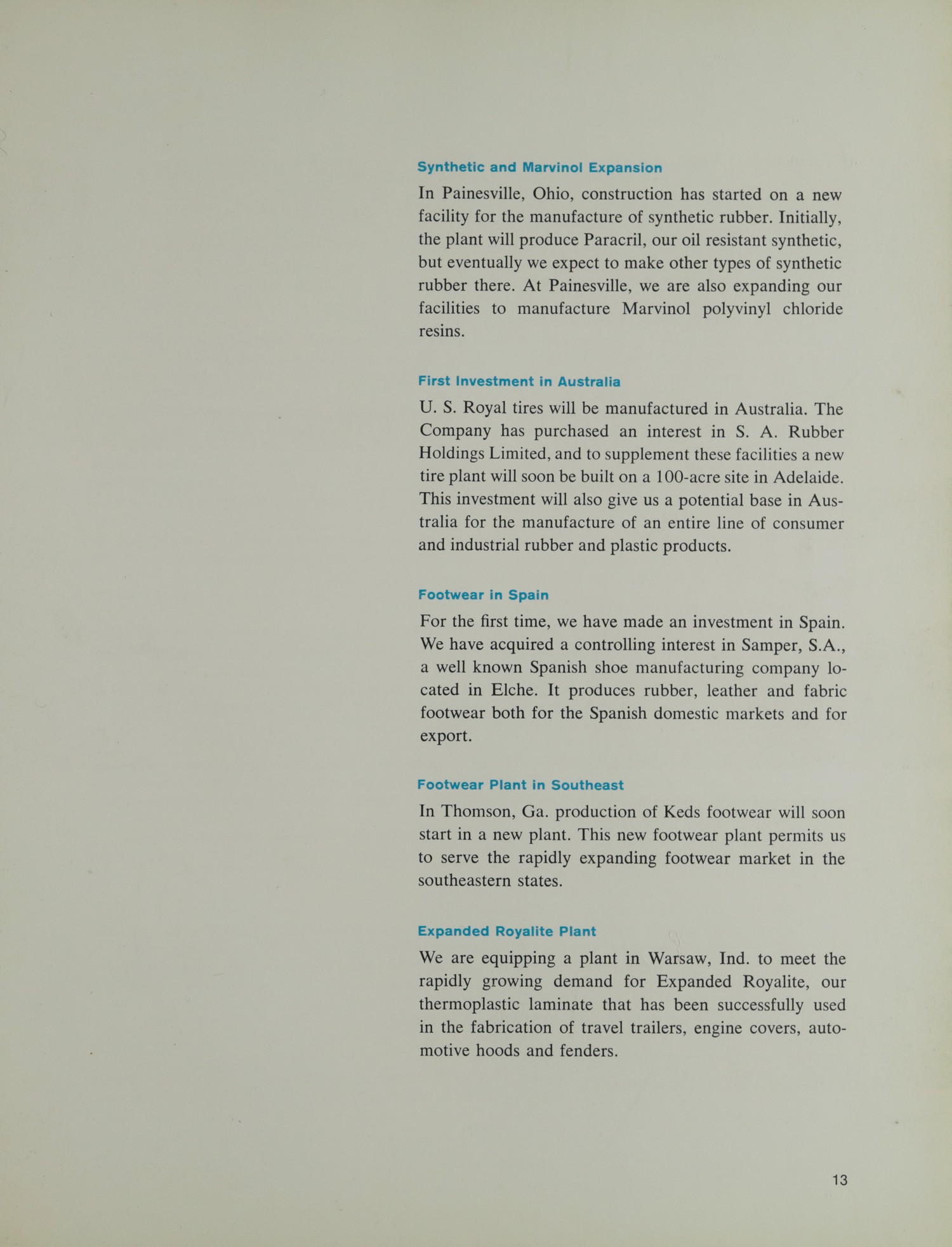

Synthetic and Marvinol Expansion

In Painesville, Ohio, construction has started on a new facility for the manufacture of synthetic rubber. Initially, the plant will produce Paracril, our oil resistant synthetic, but eventually we expect to make other types of synthetic rubber there. At Painesville, we are also expanding our facilities to manufacture Marvinol polyvinyl chloride resins.

First Investment in Australia

U. S. Royal tires will be manufactured in Australia. The Company has purchased an interest in S. A. Rubber Holdings Limited, and to supplement these facilities a new tire plant will soon be built on a 100-acre site in Adelaide. This investment will also give us a potential base in Australia for the manufacture of an entire line of consumer and industrial rubber and plastic products.

Footwear in Spain

For the first time, we have made an investment in Spain. We have acquired a controlling interest in Samper, S.A., a well known Spanish shoe manufacturing company located in Elche. It produces rubber, leather and fabric footwear both for the Spanish domestic markets and for export.

Footwear Plant in Southeast

In Thomson, Ga. production of Keds footwear will soon start in a new plant. This new footwear plant permits us to serve the rapidly expanding footwear market in the southeastern states.

Expanded Royalite Plant

We are equipping a plant in Warsaw, Ind. to meet the rapidly growing demand for Expanded Royalite, our thermoplastic laminate that has been successfully used in the fabrication of travel trailers, engine covers, automotive hoods and fenders.

—

## Page 014

Financial Review

1963 Sales and Profits Affected by Strikes

Although sales of most products in 1963 were equal to or better than 1962, strikes in four of our five tire plants seriously affected our sales of this major product.

A company-wide labor agreement with plants represented by the United Rubber, Cork, Linoleum and Plastic Workers of America was signed in June by the Company and officers of the Union. However, strikes were called in July by local unions at four of our five tire plants, over terms of local supplemental contracts.

One tire plant was reopened in mid-October, another in mid-November and a third was reopened in mid-December, with the fourth plant continuing on strike through the year end.

In addition, there was a 27 day strike at two of our chemical plants, a 10 day strike at a third chemical plant, and day strikes at one of our plastic plants and a 39 day strike at one of our Canadian footwear plants, the largest rubber footwear plant in Canada. The stoppage of production at these plants caused merchandise shortages which affected our ability to fill customers’ orders. As this report was written, all strikes had been settled.

Obviously, the cost of these strikes, both in loss of sales and higher expenses due to abnormal absorption of maintenance and other overhead expenses during the periods the plants were shut down, adversely affected our results from operations.

Sales Lower by 2.6% vs 1962

Notwithstanding the shortages of inventories caused by the strikes, our sales to customers in 1963 aggregated $980,230,000 – the second highest year in our history, being exceeded only by our peak year of 1962 when sales totaled $1,006,793,000.

Higher sales in domestic markets of footwear, foam rubber products, textiles and chemicals, and in practically all areas outside the U. S. A. helped to offset some of the decrease in domestic tire sales.

Other Income

“Other Income, Net” comprises $5,071,000 of dividends from affiliated companies, interest earned on loans to customers, securities and temporary investment of excess working cash, royalties from licensees, and other miscellaneous income items, less $1,967,000 of interest paid on short term bank loans, mostly in connection with foreign operations.

Undistributed earnings of affiliated companies (in which we own 50 per cent or less of the outstanding shares) are not included in our income. Equity in 1963 retained earnings was $362,000, equivalent to an additional six cents on our common shares.

Taxes

During 1963, we provided $24,274,000 for Federal and foreign income taxes. In addition, excise, social security, property and other taxes levied against the Company by Federal, State and local governments amounted to $83,207,000. These direct taxes aggregated $107,481,000, compared with $117,365,000 for the year 1962. In addition, in 1963, the company withheld $42,253,000 from employees’ wages and salaries for personal income and social security taxes.

The total of all taxes paid and collected was $149,734,000.

Foreign Exchange Losses

Foreign exchange losses charged against 1963 income amounted to $1,172,000, chiefly from currency devaluation in the Congo. Comparable losses in 1962 were $2,292,000, principally in Canada, Colombia, Argentina and Brazil.

—

## Page 015

United States Rubber Company and Subsidiary Companies

During 1963, the book value of the net assets of our Indonesian plantations was restated to reflect the lower foreign exchange value of the Indonesian rupiah. Such restatement had no effect on 1963 consolidated net income, since the decrease in net assets of $4,077,000 was charged to the Reserve for Foreign Activities, created from prior years’ earnings of the Indonesian plantations.

Net Income and Dividends

Net income of United States Rubber Company and subsidiaries was $22,105,000 for the year 1963, equivalent to $2.90 a common share. This compares with 1962 earnings of $25,694,000, or $3.50 a common share.

As previously indicated, earnings for the year 1963 were adversely affected by the loss of sales and abnormal absorption of maintenance and other costs during the periods certain of our manufacturing facilities were shut down because of strikes.

Preferred stockholders received regular quarterly dividends of $2.00 a share, for a total of $8.00 for the year.

Quarterly dividends of 55 cents a share, or a total of $2.20 for the year, were paid on the common shares in 1963. The same amount was paid in 1962.

Investments

Investments at December 31, 1963 amounted to $21,782,000, comprising $16,677,000 in affiliated companies, in which we own 50 per cent or less of outstanding shares, and $5,105,000 of miscellaneous investments, principally notes receivable from customers due after one year.

During 1963, we made additional investments of $4,400,000 in foreign affiliated companies for the manufacture of tires, plastics and chemicals for the Japanese, Australian and South American markets. Our equity in the net assets of affiliated companies (owned 50 per cent or less) was $25,550,000 at December 31, 1963, compared to $21,620,000 at the close of the preceding year.

Long Term Debt

Long term debt at December 31, 1963 was $157,276,000, comprising $139,436,000 for the parent company and $17,840,000 for foreign and domestic subsidiaries.

Long term debt increased by $6,346,000 during the year, comprising additional foreign borrowings of $11,625,000, less a decrease of $5,279,000 in parent company debt.

During 1963, we purchased and delivered to the Trustee for retirement $2,779,000 face value of our 25% debentures due in 1976. These purchases, together with $3,785,000 debentures held by the Trustees at January 1, 1963, satisfy 1963, 1964 and 1965 sinking fund requirements in full and leave $564,000 as an advance payment against the $2,000,000 due May 1, 1966.

At December 31, 1962, the Trustee held $168,000 of our 25% debentures due in 1967; and we purchased $2,334,000 in 1963. $2,500,000 was required to satisfy our April 1, 1963 sinking fund requirement, leaving $2,000 held by the Trustee.

Property, Plant and Equipment

At December 31, 1963, gross property was $616,458,000 of which $462,087,000 was in the United States; $65,869,000 in Canada, Central and South America; and $88,502,000 in other offshore locations.

The net book value at the close of the year was $218,861,000.

In 1963, a total of $65,491,000 was expended on property, plant and equipment. This total comprised direct expenditures of $44,648,000 for additions and improvements to properties owned by United States Rubber Company and subsidiaries; $12,862,000 towards construction of a new $21 million tire plant being financed with Industrial Revenue Bonds issued by the City of Opelika, Alabama and $7,981,000 expended as our share of capital requirements to increase the manufacturing facilities of domestic and foreign affiliated companies.

The total of all these expenditures is encompassed in the Capital Expansion Program of $300 million commented on pages 5 through 13 of this report.

For 1963, depreciation and obsolescence charged to parent and subsidiary companies’ operations aggregated $27,217,000, compared with $27,657,000 in 1962.

(Additional financial comments are offered on pages 19 and 20 of this report.)

—

## Page 016

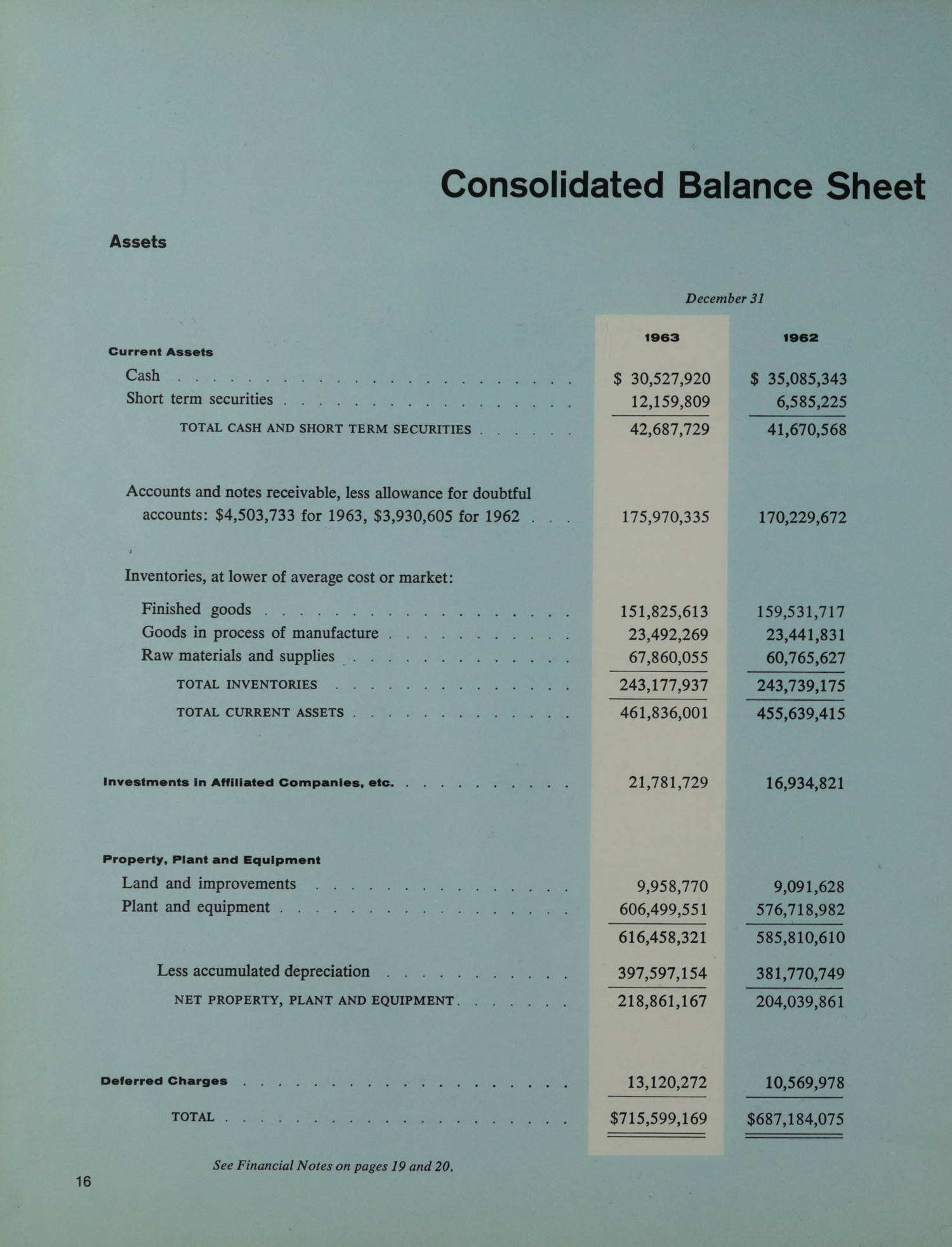

Consolidated Balance Sheet

Assets

December 31

1963 1962

Current Assets

Cash $ 30,527,920 $ 35,085,343

Short term securities 12,159,809 6,585,225

TOTAL CASH AND SHORT TERM SECURITIES 42,687,729 41,670,568

Accounts and notes receivable, less allowance for doubtful

accounts: $4,503,733 for 1963, $3,930,605 for 1962 175,970,335 170,229,672

Inventories, at lower of average cost or market:

Finished goods 151,825,613 159,531,717

Goods in process of manufacture 23,492,269 23,441,831

Raw materials and supplies 67,860,055 60,765,627

TOTAL INVENTORIES 243,177,937 243,739,175

TOTAL CURRENT ASSETS 461,836,001 455,639,415

Investments In Affiliated Companies, etc. 21,781,729 16,934,821

Property, Plant and Equipment

Land and improvements 9,958,770 9,091,628

Plant and equipment 606,499,551 576,718,982

616,458,321 585,810,610

Less accumulated depreciation 397,597,154 381,770,749

NET PROPERTY, PLANT AND EQUIPMENT 218,861,167 204,039,861

Deferred Charges 13,120,272 10,569,978

TOTAL $715,599,169 $687,184,075

See Financial Notes on pages 19 and 20.

16

—

## Page 017

United States Rubber Company and Subsidiary Companies

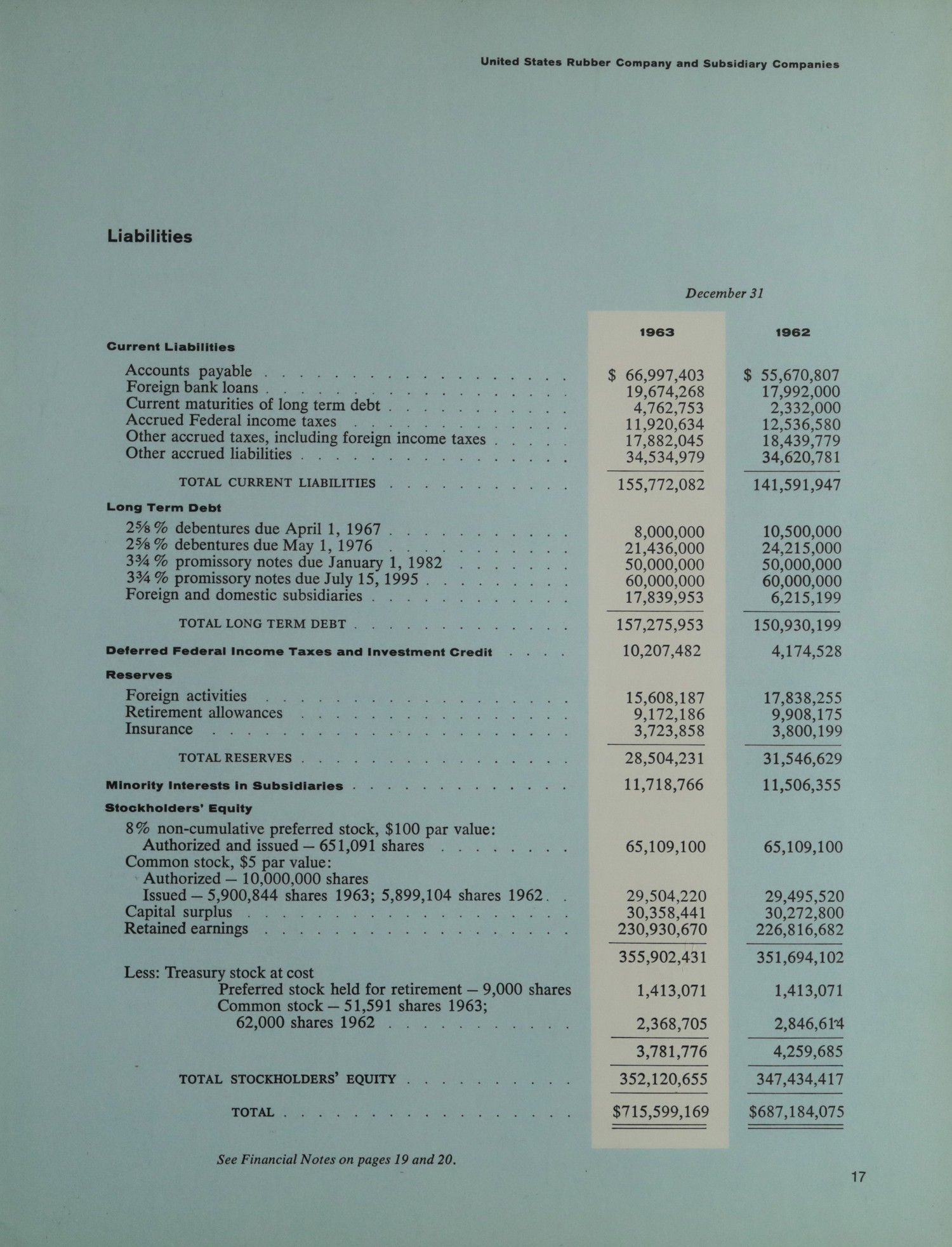

Liabilities

December 31

1963 1962

Current Liabilities

Accounts payable . . . . . . . . . . . . . . . . $ 66,997,403 $ 55,670,807

Foreign bank loans . . . . . . . . . . . . . . . 19,674,268 17,992,000

Current maturities of long term debt . . . . . . . 4,762,753 2,332,000

Accrued Federal income taxes . . . . . . . . . . . 11,920,634 12,536,580

Other accrued taxes, including foreign income taxes . 17,882,045 18,439,779

Other accrued liabilities . . . . . . . . . . . . . . 34,534,979 34,620,781

TOTAL CURRENT LIABILITIES . . . . . . . . . . 155,772,082 141,591,947

Long Term Debt

2½ % debentures due April 1, 1967 . . . . . . . . 8,000,000 10,500,000

2½ % debentures due May 1, 1976 . . . . . . . . . 21,436,000 24,215,000

3¾ % promissory notes due January 1, 1982 . . . . 50,000,000 50,000,000

3¾ % promissory notes due July 15, 1995 . . . . . 60,000,000 60,000,000

Foreign and domestic subsidiaries . . . . . . . . . 17,839,953 6,215,199

TOTAL LONG TERM DEBT . . . . . . . . . . . 157,275,953 150,930,199

Deferred Federal Income Taxes and Investment Credit . . . 10,207,482 4,174,528

Reserves

Foreign activities . . . . . . . . . . . . . . . . . 15,608,187 17,838,255

Retirement allowances . . . . . . . . . . . . . . 9,172,186 9,908,175

Insurance . . . . . . . . . . . . . . . . . . . . . 3,723,858 3,800,199

TOTAL RESERVES . . . . . . . . . . . . . . . 28,504,231 31,546,629

Minority Interests in Subsidiaries . . . . . . . . . . . . 11,718,766 11,506,355

Stockholders’ Equity

8% non-cumulative preferred stock, $100 par value:

Authorized and issued — 651,091 shares . . . . 65,109,100 65,109,100

Common stock, $5 par value:

Authorized — 10,000,000 shares

Issued — 5,900,844 shares 1963; 5,899,104 shares 1962 . 29,504,220 29,495,520

Capital surplus . . . . . . . . . . . . . . . . . . 30,358,441 30,272,800

Retained earnings . . . . . . . . . . . . . . . . . 230,930,670 226,816,682

355,902,431 351,694,102

Less: Treasury stock at cost

Preferred stock held for retirement — 9,000 shares 1,413,071 1,413,071

Common stock — 51,591 shares 1963;

62,000 shares 1962 . . . . . . . . . . . . . . . 2,368,705 2,846,614

3,781,776 4,259,685

TOTAL STOCKHOLDERS’ EQUITY . . . . . . . . 352,120,655 347,434,417

TOTAL . . . . . . . . . . . . . . . . . . . . . $715,599,169 $687,184,075

See Financial Notes on pages 19 and 20.

—

## Page 018

United States Rubber Company and Subsidiary Companies

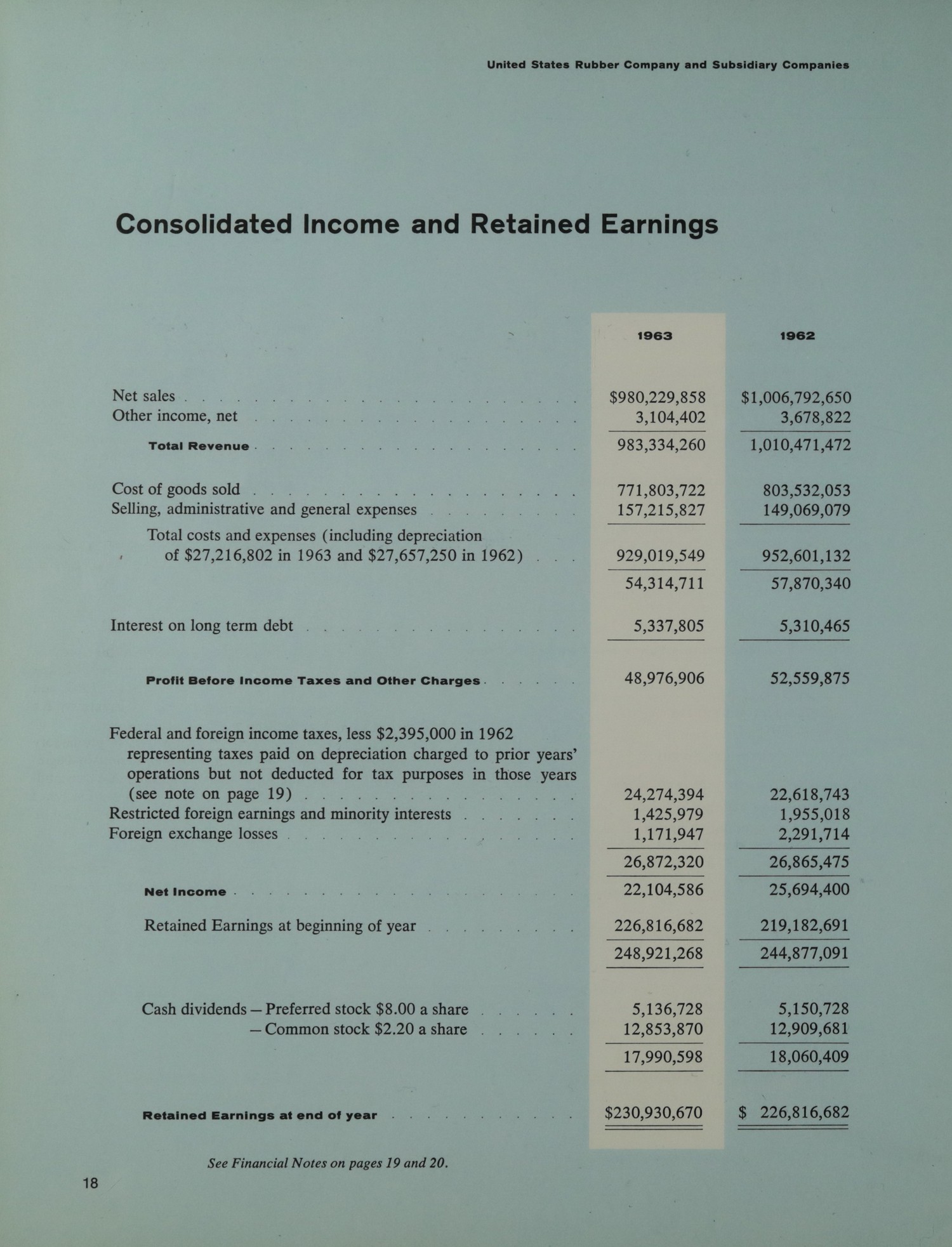

Consolidated Income and Retained Earnings

1963 1962

Net sales $980,229,858 $1,006,792,650

Other income, net 3,104,402 3,678,822

Total Revenue 983,334,260 1,010,471,472

Cost of goods sold 771,803,722 803,532,053

Selling, administrative and general expenses 157,215,827 149,069,079

Total costs and expenses (including depreciation

of $27,216,802 in 1963 and $27,657,250 in 1962)

929,019,549 952,601,132

54,314,711 57,870,340

Interest on long term debt 5,337,805 5,310,465

Profit Before Income Taxes and Other Charges 48,976,906 52,559,875

Federal and foreign income taxes, less $2,395,000 in 1962

representing taxes paid on depreciation charged to prior years’

operations but not deducted for tax purposes in those years

(see note on page 19) 24,274,394 22,618,743

Restricted foreign earnings and minority interests

1,425,979 1,955,018

Foreign exchange losses 1,171,947 2,291,714

26,872,320 26,865,475

Net Income 22,104,586 25,694,400

Retained Earnings at beginning of year 226,816,682 219,182,691

248,921,268 244,877,091

Cash dividends – Preferred stock $8.00 a share 5,136,728 5,150,728

– Common stock $2.20 a share 12,853,870 12,909,681

17,990,598 18,060,409

Retained Earnings at end of year $230,930,670 $ 226,816,682

See Financial Notes on pages 19 and 20.

18

—

## Page 019

United States Rubber Company and Subsidiary Companies

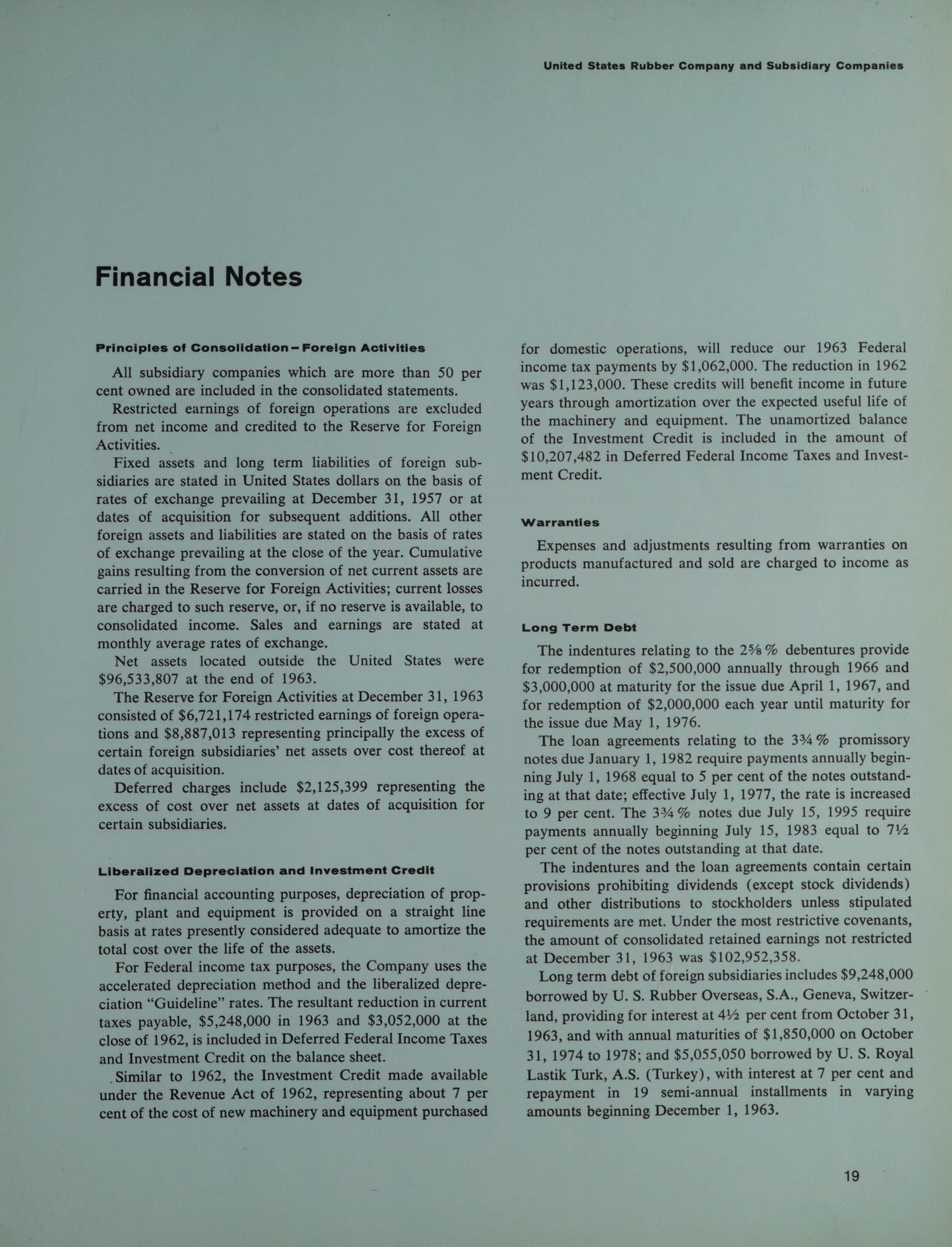

Financial Notes

Principles of Consolidation – Foreign Activities

All subsidiary companies which are more than 50 per cent owned are included in the consolidated statements. Restricted earnings of foreign operations are excluded from net income and credited to the Reserve for Foreign Activities.

Fixed assets and long term liabilities of foreign subsidiaries are stated in United States dollars on the basis of rates of exchange prevailing at December 31, 1957 or at dates of acquisition for subsequent additions. All other foreign assets and liabilities are stated on the basis of rates of exchange prevailing at the close of the year. Cumulative gains resulting from the conversion of net current assets are carried in the Reserve for Foreign Activities; current losses are charged to such reserve, or, if no reserve is available, to consolidated income. Sales and earnings are stated at monthly average rates of exchange.

Net assets located outside the United States were $96,533,807 at the end of 1963.

The Reserve for Foreign Activities at December 31, 1963 consisted of $6,721,174 restricted earnings of foreign operations and $8,887,013 representing principally the excess of certain foreign subsidiaries’ net assets over cost thereof at dates of acquisition.

Deferred charges include $2,125,399 representing the excess of cost over net assets at dates of acquisition for certain subsidiaries.

Liberalized Depreciation and Investment Credit

For financial accounting purposes, depreciation of property, plant and equipment is provided on a straight line basis at rates presently considered adequate to amortize the total cost over the life of the assets.

For Federal income tax purposes, the Company uses the accelerated depreciation method and the liberalized depreciation “guideline” rates. The resultant reduction in current taxes payable, $5,248,000 in 1963 and $3,052,000 at the close of 1962, is included in Deferred Federal Income Taxes and Investment Credit on the balance sheet.

Similar to 1962, the Investment Credit made available under the Revenue Act of 1962, representing about 7 per cent of the cost of new machinery and equipment purchased for domestic operations, will reduce our 1963 Federal income tax payments by $1,062,000. The reduction in 1962 was $1,123,000. These credits will benefit income in future years through amortization over the expected useful life of the machinery and equipment. The unamortized balance of the Investment Credit is included in the amount of $10,207,482 in Deferred Federal Income Taxes and Investment Credit.

Warranties

Expenses and adjustments resulting from warranties on products manufactured and sold are charged to income as incurred.

Long Term Debt

The indentures relating to the 2⅝% debentures provide for redemption of $2,500,000 annually through 1966 and $3,000,000 annually for the issue due April 1, 1967, and for redemption of $2,000,000 each year until maturity for the issue due March 1, 1976.

The loan agreements relating to the 3⅜% promissory notes due January 1, 1982 require payments annually beginning July 1, 1968 equal to 5 per cent of the notes outstanding at that date; effective July 1, 1977, the rate is increased to 9 per cent. The 3⅜% notes due July 15, 1995 require payments annually beginning July 15, 1983 equal to 7⅞ per cent of the notes outstanding at that date.

The indentures and the loan agreements contain certain provisions prohibiting dividends (except stock dividends) and other distributions to stockholders unless stipulated requirements are met. Under the most restrictive covenants, the amount of consolidated retained earnings not restricted at December 31, 1963 was $102,952,358.

Long term debt of foreign subsidiaries includes $9,248,000 borrowed by U.S. Rubber Overseas, S.A., Geneva, Switzerland, providing for interest at 4½ per cent from October 31, 1963, and with annual maturities of $1,850,000 on October 31, 1974 to 1978; and $5,055,050 borrowed by U.S. Royal Lastik Turk, A.S. (Turkey), with interest at 7 per cent and repayment in 19 semi-annual installments in varying amounts beginning December 1, 1963.

—

## Page 020

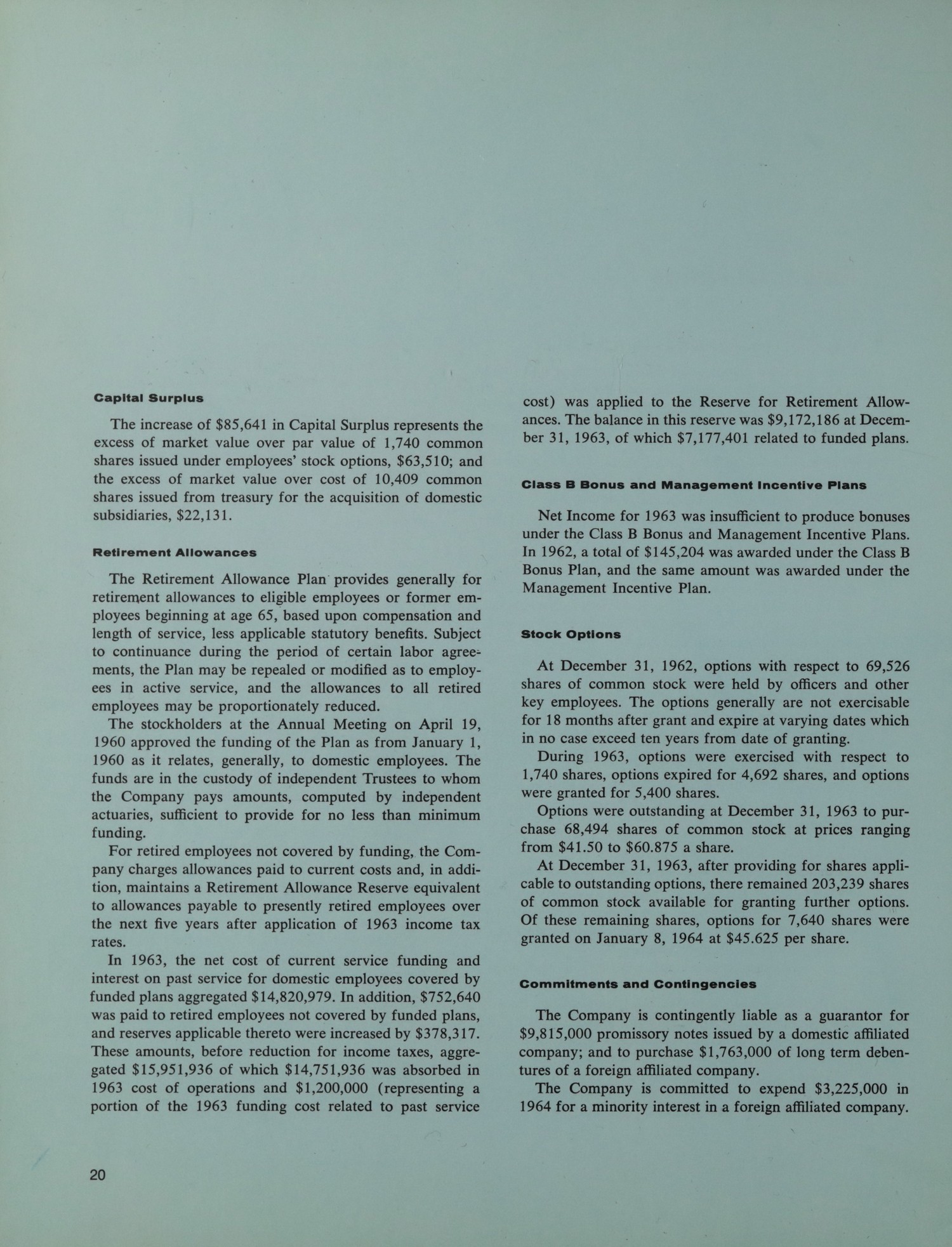

Capital Surplus

The increase of $85,641 in Capital Surplus represents the

excess of market value over par value of 1,740 common

shares issued under employees’ stock options, $63,510; and

the excess of market value over cost of 10,409 common

shares issued from treasury for the acquisition of domestic

subsidiaries, $22,131.

Retirement Allowances

The Retirement Allowance Plan provides generally for

retirement allowances to eligible employees or former em-

ployees beginning at age 65, based upon compensation and

length of service, less applicable statutory benefits. Subject

to continuance during the period of certain labor agree-

ments, the Plan may be repealed or modified as to employ-

ees in active service, and the allowances to all retired

employees may be proportionately reduced.

The stockholders at the Annual Meeting on April 19,

1960 approved the funding of the Plan as from January 1,

1960 as it relates, generally, to domestic employees. The

funds are in the custody of Independent Trustees to whom

the Company pays amounts, computed by independent

actuaries, sufficient to provide for no less than minimum

funding.

For retired employees not covered by funding, the Com-

pany charges allowances paid to current costs and, in addi-

tion, maintains a Retirement Allowance Reserve equivalent

to allowances payable to presently retired employees over

the next five years after application of 1963 income tax

rates.

In 1963, the net cost of current service funding and

interest on past service for domestic employees covered by

funded plans aggregated $14,820,979. In addition, $752,640

was paid to retired employees not covered by funded plans,

and reserves applicable thereto were increased by $378,317.

These amounts, before reduction for income taxes, aggre-

gated $15,951,936 of which $14,751,936 was absorbed in

1963 cost of operations and $1,200,000 (representing a

portion of the 1963 funding cost related to past service

cost) was applied to the Reserve for Retirement Allow-

ances. The balance in this reserve was $9,172,186 at Decem-

ber 31, 1963, of which $7,177,401 related to funded plans.

Class B Bonus and Management Incentive Plans

Net Income for 1963 was insufficient to produce bonuses

under the Class B Bonus and Management Incentive Plans.

In 1962, a total of $145,204 was awarded under the Class B

Bonus Plan, and the same amount was awarded under the

Management Incentive Plan.

Stock Options

At December 31, 1962, options with respect to 69,526

shares of common stock were held by officers and other

key employees. The options generally are not exercisable

for 18 months after grant and expire at varying dates which

in no case exceed ten years from date of granting.

During 1963, options were exercised with respect to

1,740 shares, options expired for 4,692 shares, and options

were granted for 5,400 shares.

Options were outstanding at December 31, 1963 to pur-

chase 68,494 shares of common stock at prices ranging

from $41.50 to $60.875 a share.

At December 31, 1963, after providing for shares appli-

cable to outstanding options, there remained 203,239 shares

of common stock available for granting further options.

Of these remaining shares, options for 7,640 shares were

granted on January 8, 1964 at $45.625 per share.

Commitments and Contingencies

The Company is contingently liable as a guarantor for

$9,815,000 promissory notes issued by a domestic affiliated

company; and to purchase $1,763,000 of long term deben-

tures of a foreign affiliated company.

The Company is committed to expend $3,225,000 in

1964 for a minority interest in a foreign affiliated company.

—

## Page 021

United States Rubber Company and Subsidiary Companies

Accountants’ Opinion

HASKINS & SELLS

CERTIFIED PUBLIC ACCOUNTANTS

TWO BROADWAY

NEW YORK 4

February 12, 1964

United States Rubber Company:

We have examined the consolidated balance sheet of United States Rubber Company and its subsidiary companies as of December 31, 1963 and the related statement of consolidated income and retained earnings for the year then ended. Our examination was made in accordance with generally accepted auditing standards, and accordingly included such tests of the accounting records and such other auditing procedures as we considered necessary in the circumstances.

In our opinion, the accompanying consolidated balance sheet and statement of consolidated income and retained earnings present fairly the financial position of the companies at December 31, 1963 and the results of their operations for the year then ended, in conformity with generally accepted accounting principles applied on a basis consistent with that of the preceding year.

Haskins & Sells.

—

## Page 022

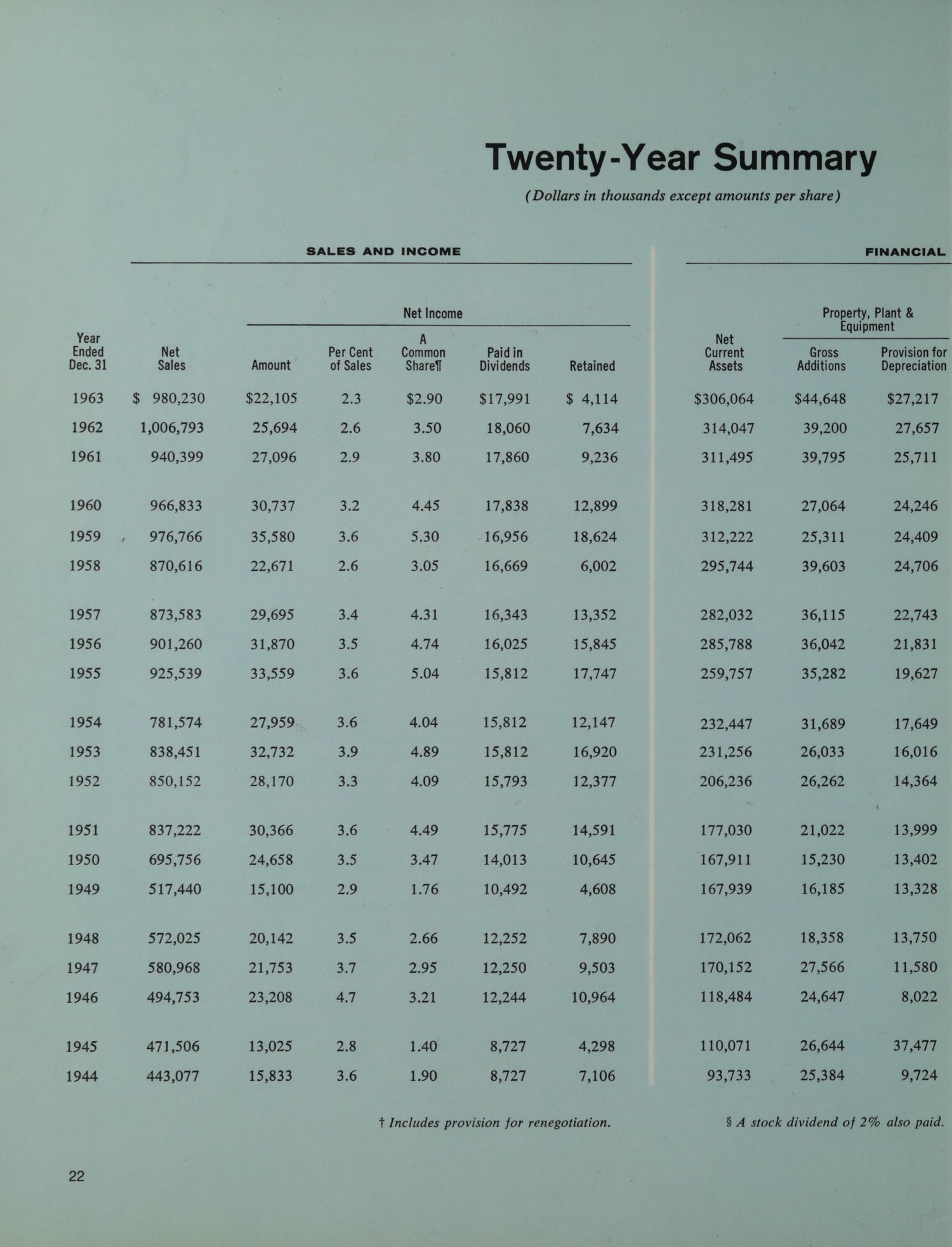

Twenty-Year Summary

(Dollars in thousands except amounts per share)

SALES AND INCOME FINANCIAL

Year Net Per Cent Paid in Property, Plant &

Ended Sales Net of Sales Dividends Equipment

Dec. 31 Amount Common Retained Net Gross Provision for

1963 $ 980,230 $22,105 2.3 $17,991 $ 4,114 $306,064 $44,648 $27,217

1962 1,006,793 25,694 2.6 18,060 7,634 314,047 39,200 27,657

1961 940,399 27,096 2.9 17,860 9,236 311,495 39,795 25,711

1960 966,833 30,737 3.2 17,838 12,899 318,281 27,064 24,246

1959 , 976,766 35,580 3.6 16,956 18,624 312,222 25,311 24,409

1958 870,616 22,671 2.6 16,669 6,002 295,744 39,603 24,706

1957 873,583 29,695 3.4 16,343 13,352 282,032 36,115 22,743

1956 901,260 31,870 3.5 16,025 15,845 285,788 36,042 21,831

1955 925,539 33,559 3.6 15,812 17,747 259,757 35,282 19,627

1954 781,574 27,959 3.6 15,812 12,147 232,447 31,689 17,649

1953 838,451 32,732 3.9 15,812 16,920 231,256 26,033 16,016

1952 850,152 28,170 3.3 15,793 12,377 206,236 26,262 14,364

1951 837,222 30,366 3.6 15,775 14,591 177,030 21,022 13,999

1950 695,756 24,658 3.5 14,013 10,645 167,911 15,230 13,402

1949 517,440 15,100 2.9 10,492 4,608 167,939 16,185 13,328

1948 572,025 20,142 3.5 12,252 7,890 172,062 18,358 13,750

1947 580,968 21,753 3.7 12,250 9,503 170,152 27,566 11,580

1946 494,753 23,208 4.7 12,244 10,964 118,484 24,647 8,022

1945 471,506 13,025 2.8 8,727 4,298 110,071 26,644 37,477

1944 443,077 15,833 3.6 8,727 7,106 93,733 25,384 9,724

† Includes provision for renegotiation.

$ A stock dividend of 2% also paid.

—

## Page 023

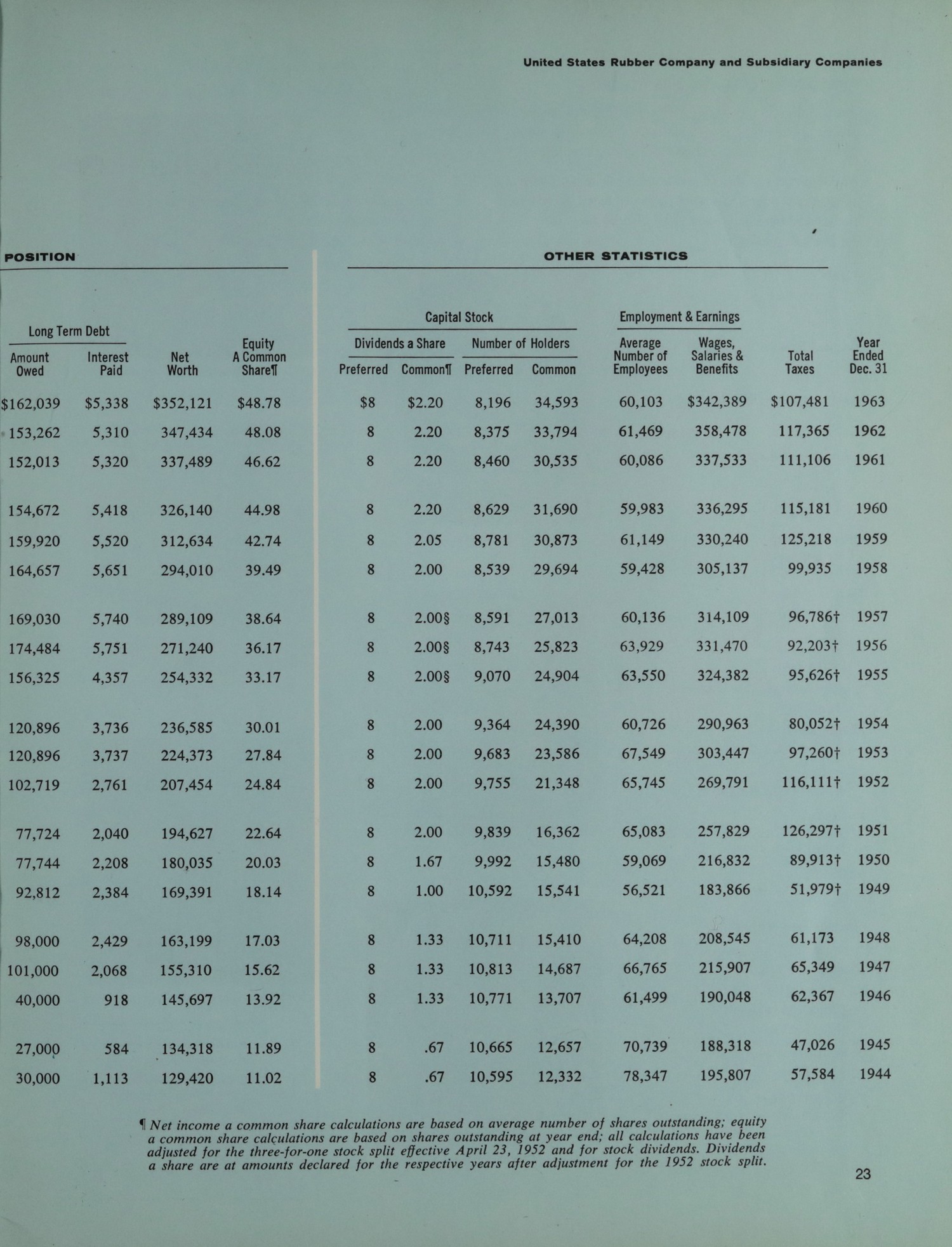

United States Rubber Company and Subsidiary Companies

POSITION OTHER STATISTICS

Long Term Debt Capital Stock Employment & Earnings

Amount Interest Net Equity Dividends a Share Number of Holders Average Wages, Total Year

Owed Paid Worth Share* Preferred Common† Preferred Common Number of Employees Benefits Taxes Ended

Employees Dec. 31

$162,039 $5,338 $352,121 $48.78 $8 $2.20 8,196 34,593 60,103 $342,389 $107,481 1963

153,262 5,310 347,434 48.08 8 2.20 8,375 33,794 61,469 358,478 117,365 1962

152,013 5,320 337,489 46.62 8 2.20 8,460 30,535 60,086 337,533 111,106 1961

154,672 5,418 326,140 44.98 8 2.20 8,629 31,690 59,983 336,295 115,181 1960

159,920 5,520 312,634 42.74 8 2.05 8,781 30,873 61,149 330,240 125,218 1959

164,657 5,651 294,010 39.49 8 2.00 8,539 29,694 59,428 305,137 99,935 1958

169,030 5,740 289,109 38.64 8 2.00$ 8,591 27,013 60,136 314,109 96,786† 1957

174,484$ 5,751 271,240 36.17 8 2.00$ 8,743 25,823 63,929 331,470 92,203† 1956

156,325 4,357 254,332 33.17 8 2.00$ 9,070 24,904 63,550 324,382 95,626† 1955

120,896 3,736 236,585 30.01 8 2.00 9,364 24,390 60,726 290,963 80,052† 1954

120,896 3,737 224,373 27.84 8 2.00 9,683 23,586 67,549 303,447 97,260† 1953

102,719 2,761 207,454 24.84 8 2.00 9,755 21,348 65,745 269,791 116,111† 1952

77,724 2,040 194,627 22.64 8 2.00 9,839 16,362 65,083 257,829 126,297† 1951

77,744 2,208 180,035 20.03 8 1.67 9,992 15,480 59,069 216,832 89,913† 1950

92,812 2,384 169,391 18.14 8 1.00 10,592 15,541 56,521 183,866 51,979† 1949

98,000 2,429 163,199 17.03 8 1.33 10,711 15,410 64,208 208,545 61,173 1948

101,000 2,068 155,310 15.62 8 1.33 10,813 14,687 66,765 215,907 65,349 1947

40,000 918 145,697 13.92 8 1.33 10,771 13,707 61,499 190,048 62,367 1946

27,000 584 134,318 11.89 8 .67 10,665 12,657 70,739 188,318 47,026 1945

30,000 1,113 129,420 11.02 8 .67 10,595 12,332 78,347 195,807 57,584 1944

* Net income a common share calculations are based on average number of shares outstanding; equity

a common share calculations are based on shares outstanding at year-end; all calculations have been

adjusted for the three-for-one stock split effective April 23, 1952 and for stock dividends. Dividends

a share are at amounts declared for the respective years after adjustment for the 1952 stock split.

—

## Page 024

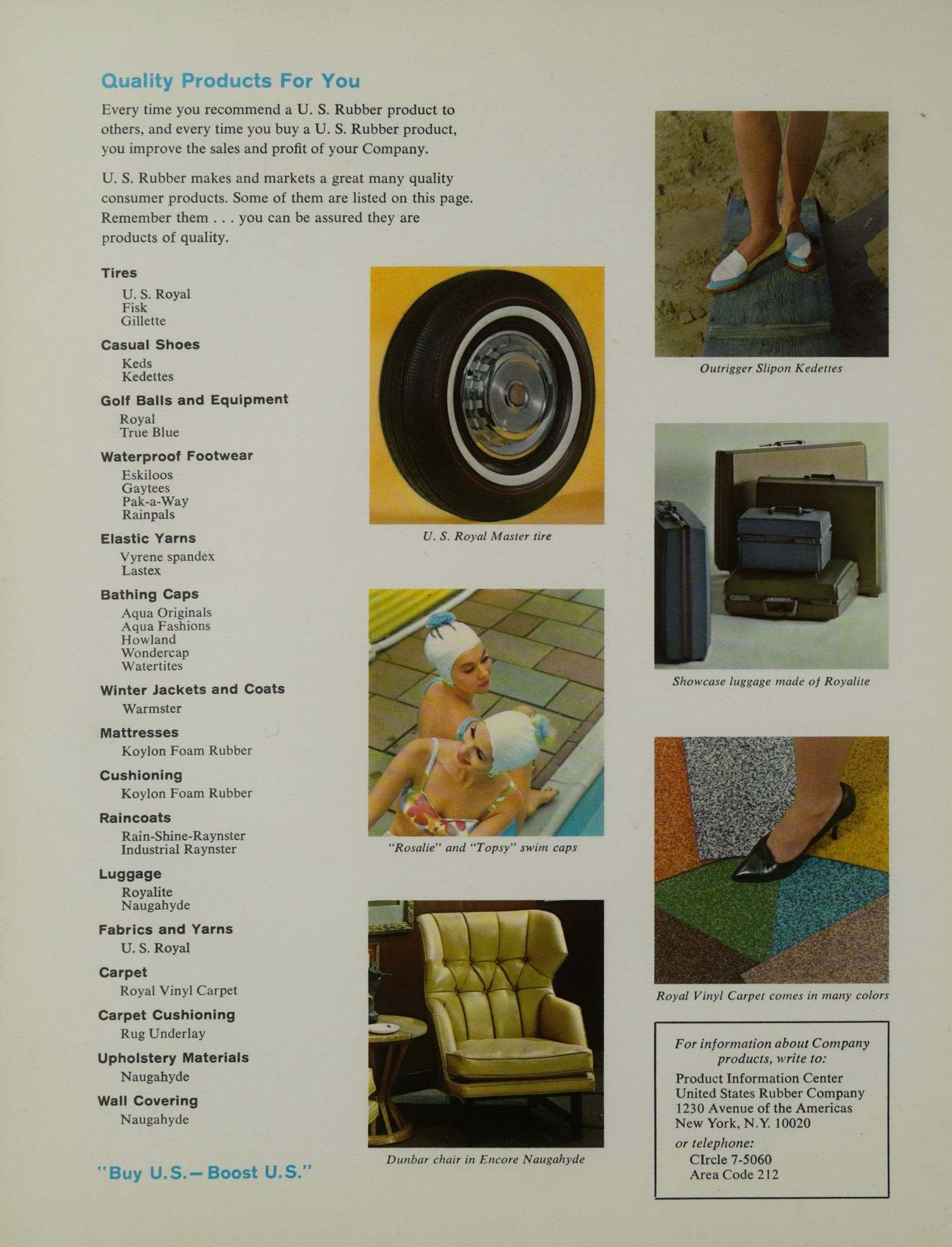

Quality Products For You

Every time you recommend a U. S. Rubber product to others, and every time you buy a U. S. Rubber product, you improve the sales and profit of your Company.

U. S. Rubber makes and markets a great many quality consumer products. Some of them are listed on this page. Remember them . . . you can be assured they are products of quality.

Tires

U. S. Royal

Fisk

Gillette

Casual Shoes

Keds

Kedettes

Golf Balls and Equipment

Royal

True Blue

Waterproof Footwear

Eskilos

Gaytes

Pak-a-Way

Rainpals

Elastic Yarns

Vyrtene spandex

Lastex

Bathing Caps

Aqua Originals

Aqua Fashions

Aerland

Wondercap

Watertites

Winter Jackets and Coats

Warmster

Mattresses

Koylon Foam Rubber

Cushioning

Koylon Foam Rubber

Raincoats

Rain-Shine-Raynster

Industrial Raynster

Luggage

Royalite

Naugahyde

Fabrics and Yarns

U. S. Royal

Carpet

Royal Vinyl Carpet

Carpet Cushioning

Rug Underlay

Upholstery Materials

Naugahyde

Wall Covering

Naugahyde

“Buy U.S.—Boost U.S.”

Outriger Slipon Kedettes

U. S. Royal Master tire

“Rosalie” and “Topsy” swim caps

Dunbar chair in Encore Naugahyde

Showcase luggage made of Royalite

Royal Vinyl Carpet comes in many colors

For information about Company products, write to:

Product Information Center

United States Rubber Company

1230 Avenue of the Americas

New York, N.Y. 10020

or telephone:

Circle 7-5060

Area Code 212

—

## Page 025

Board of Directors

H. E. Humphreys, Jr. Chairman of the Board

George R. Vila President and Chief Executive Officer

Eugene N. Beesley President, Eli Lilly and Company

J. Simpson Dean President, Nemours Corporation

George P. Edmonds Chairman, Wilmington Trust Company

Malcolm P. Ferguson President, Bendix Corporation

G. Arnold Hart President, Bank of Montreal

Harold H. Helm Chairman, Chemical Bank New York Trust Company

James P. Lewis President, Latex Fiber Industries, Inc.

John W. McGovern Retired as President, 1960

Robert J. McKim Chairman, Associated Dry Goods Corporation

John M. Schiff Partner of Kuhn, Loeb & Co.

W. Dent Smith President, Terminal Warehouses, Ltd.

Charles M. Spofford Partner, Davis Polk Wardwell Sunderland and Kiendl

Medley G. B. Whelpley Retired Corporate Executive

ADVISORY DIRECTORS

Herbert E. Smith, former Chairman and President

Thomas J. Needham, former Vice President

Officers of the Company

its divisions, departments and principal subsidiaries

H. E. Humphreys, Jr. Chairman, Board of Directors

George R. Vila President and Chief Executive Officer

Walter D. Baldwin Vice President, Corporate Sales

E. M. Cushing Vice President, Industrial Relations Department

Earle S. Ebers Vice President and Group Executive, polymers, fibers and chemicals

Frank J. McGrath Financial Vice President and Treasurer

C. William Pennington Vice President and Group Executive, tires, consumer and industrial products

Perce C. Rowe Vice President, Market Development

Leland M. White Vice President, Research and Engineering

G. T. Pownall Secretary

Claude H. Allard Vice President and General Manager, Textile Division

M. F. Anderson President, Dominion Rubber Company, Ltd.

Harold N. Barrett President, U. S. Rubber Tire Co.

F. Dudley Chittenden Vice President and General Manager, Naugatuck Chemical Division

Louis J. Healey President, Consumer and Industrial Products Division

Edward J. Higgins President, U. S. Rubber International Company

James P. Lewis President, Latex Fiber Industries, Inc.

Executive Committee:

Mr. Humphreys, Chairman;

Messrs. Vila, Edmonds,

McGovern, Schiff and Whelpley.

Salary and Bonus Committee:

Mr. McGovern, Chairman;

Messrs. Edmonds,

Schiff and Whelpley.

Audit Committee:

Mr. Edmonds, Chairman;

Messrs. Helm and Spofford.

—

## Page 033

United States

General Offices: 1230 Avenue of the Americas, New York, N. Y. 10020 Research Center: Wayne, New Jersey

EXISTING PLANTS

ALABAMA: Opelika

CALIFORNIA: Los Angeles

Santa Ana

CONNECTICUT: Bethany

Naugatuck

Sandy Hook

Waterbury

GEORGIA: Conyers

Dalton

Hogansville

Thomson

ILLINOIS: Chicago

INDIANA: Indianapolis

Mishawaka

Warsaw

Washington

LOUISIANA: Baton Rouge

Geismar

Scotts Bluff

MARYLAND: Baltimore

MASSACHUSETTS: Chicopee Falls

Medford

MICHIGAN: Detroit

NEW JERSEY: Passaic

Wayne

NEW YORK: Beaver Falls

NORTH CAROLINA: Gastonia

Raeford

Waxhaw

OHIO: Painesville

PENNSYLVANIA: Philadelphia

Wykes-Barre

RHODE ISLAND: Providence

Woonsocket

SOUTH CAROLINA: Winnsboro

TENNESSEE: Shelbyville

TEXAS: Laredo

Port Neches

VIRGINIA: Scottsville

WISCONSIN: Eau Claire

Stoughton

MAJOR EXPANSIONS

PAINESVILLE, OHIO

Synthetic rubber chloride

GEISMAR, LA.

Acetylene & vinyl monomers

Agricultural chemicals

Rubber chemicals

Royalene synthetic rubber

Aniline and

tolylene diisocyanates

THOMSON, GA.

Footwear

OPELIKA, ALA.

Tires

SCOTT’S BLUFF, LA.

Kratolitic resins

WARSAW, IND.

Expanded Royalite plastic parts

WINNSBORO, S.C.

Nylon tire cord

Polypropylene fiber

Textile sales and development

headquarters

NAUGATUCK, CONN.

Management information and

data processing center

LAREDO, TEX.

Tire test track

WILKES-BARRE, PA.

Tread rubber

Aircraft tire recapping

CONYERS, GA.

Tread rubber

Aircraft tire recapping

GASTONIA, N.C.

Vyrene fiber plant

Come To The Fair!

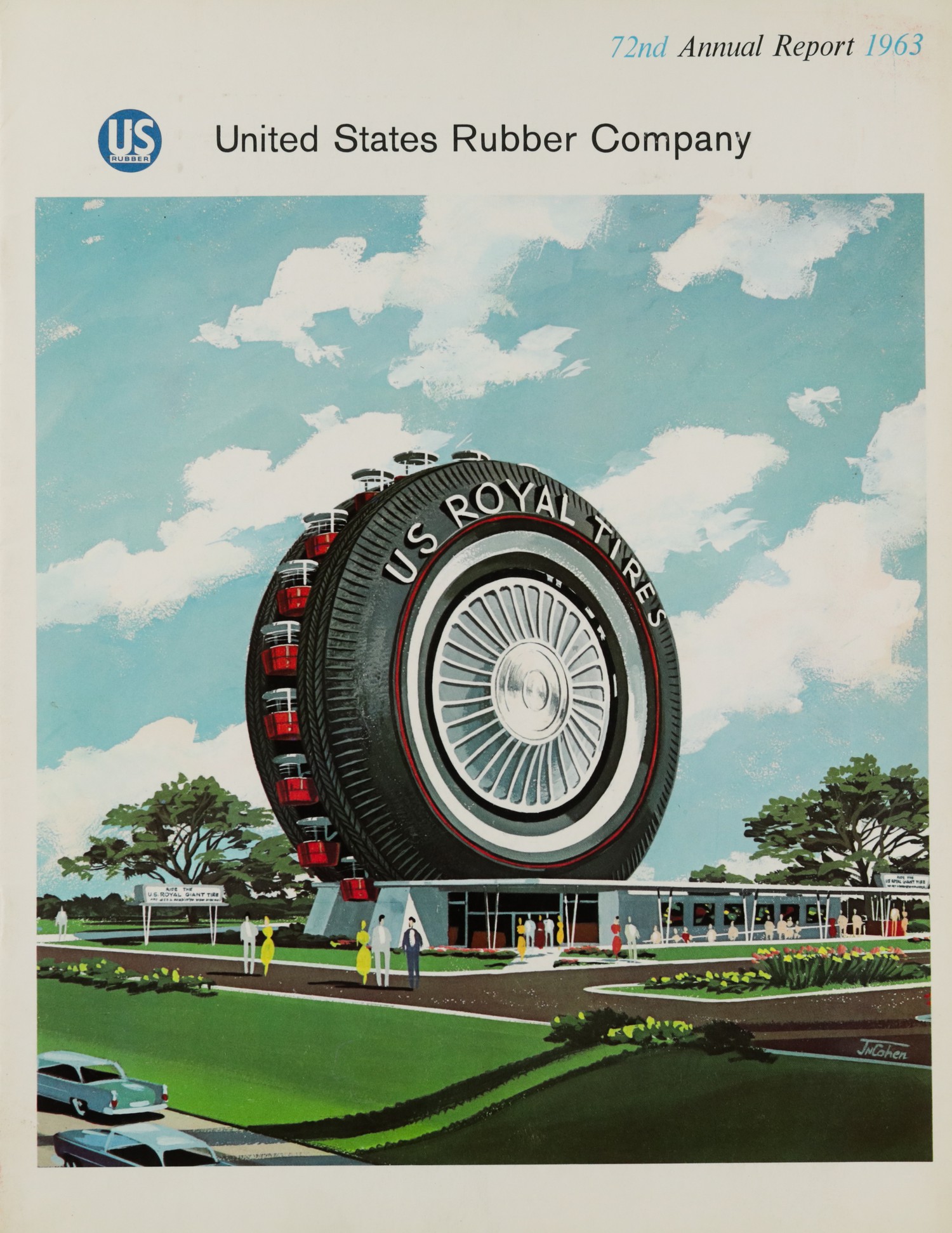

ON OUR COVER is an artist’s sketch of the giant tire which

United States Rubber Company will operate at the New York

World’s Fair, opening in April. The tire is 80 feet high and

will have a capacity of 96 passengers in 24 barrel-shaped

gondolas. The gondolas will move around the circumference

of the tire, affording a high and clear view of the Fair grounds

for sightseers and camera enthusiasts.

Outside U.S.A.

EXISTING PLANTS

The Company owns or is affiliated or

associated with manufacturing units in

these locations abroad:

ARGENTINA INDIA

AUSTRALIA INDONESIA

BELGIUM ITALY

BRAZIL JAPAN

COLOMBIA MALAYSIA

ENGLAND MEXICO

FRANCE PUERTO RICO

SCOTLAND

SOUTH AFRICA

SPAIN

SWEDEN

TURKEY

VENEZUELA

WALES

WEST GERMANY

Canada

ALBERTA: Edmonton

ONTARIO: Elmira

Guelph

Kitchener

QUEBEC: Montreal

St. Jerome

MAJOR EXPANSIONS

ARGENTINA

Chemicals

Synthetics

Carbon black

Other hydrocarbon materials

TURKEY

Tires

ENGLAND

Synthetic latices

Plastics

Royalite plastics

Golf balls

CANADA

Chemicals

Reclaimed rubber

Tire cord

ITALY

Coated fabrics

Chemicals

SPAIN

Footwear

BELGIUM

Tires

JAPAN

Synthetic rubber and plastics

Tires

AUSTRALIA

Tires

Consumer & industrial products

—

## Page letter

United States Rubber Company

Rockefeller Center

1230 AVENUE OF THE AMERICAS • NEW YORK 20, N.Y.

OFFICE OF THE

CHAIRMAN OF THE BOARD

March 17, 1964

To the Stockholders of

UNITED STATES RUBBER COMPANY:

The annual meeting of stockholders of United States Rubber Company will be held on Tuesday, April 21, 1964, at 10:30 a.m., in the Starlight Roof of the Waldorf-Astoria Hotel, 106 Central Park South, New York, New York. At this meeting stockholders will be asked to elect a board of directors for the coming year, to decide whether the company’s Bonus Plan and its Management Incentive Plan shall each be continued in effect, to consider and act upon the adoption of a proposed 1964 Stock Option Plan, and to transact such other business as may properly come before the meeting.

Under the provisions of the company’s Bonus Plan and its Management Incentive Plan, the board of directors is required to submit to the stockholders, at intervals of no more than five years, the question of whether each of those plans shall be continued in effect. The board of directors has passed a resolution declaring it advisable, and recommending to the stockholders, that both plans be continued in effect in their respective existing forms.

A proposed 1964 Stock Option Plan, described in the accompanying proxy statement, has been formulated by the board of directors for consideration by the stockholders. The board of directors has passed a resolution declaring the adoption of such plan advisable and directing that the forthcoming annual meeting be called for the purpose, among others, of taking action thereon.

The board of directors has fixed March 4, 1964, at the close of business, as the record date for the determination of stockholders entitled to vote at the meeting.

Your vote is important. Please sign and return the accompanying proxy in the enclosed addressed envelope. If you attend the meeting and wish to vote in person, you may withdraw your proxy. If you are planning to attend the meeting, it will be greatly appreciated if you will notify Mr. G. T. Pownall, Secretary, so that we may send you an attendance card.

Sincerely yours,

H. E. HUMPHREYS, JR.

Chairman of the Board of Directors

—